In 2018, worldwide sales of passenger cars and light commercial vehicles decreased for the first time since 2009, as carmakers sold 0.5% fewer vehicles, according to JATO Dynamics figures, based on their data of 54 top markets. Slightly over 400.000 fewer vehicle sales compared to 2017 make for a new total of 86.01 million global car sales. Passenger car and pick up sales were down 0.6% to 81.84 million and LCV sales were up 2.5 to 4.17 million vehicles. Of the major markets double digit growth was recorded by Thailand (+20%), Brazil (+14%) and Russia (+13%), the latter now a larger market than South Korea (+1,4%), while sales declined by double digits in Turkey (-35%) and Argentina (-10%) as these two countries battled economic downturns. But small declines in Europe, United States, and most significantly China had a great impact on global car sales. India on the other hand set a fourth consecutive annual sales record and finally surpassed Germany to become the world’s fourth largest car market. The fastest growing segment worldwide was that of EVs, which increased by more than 73% to over 1.2 million sales.

In 2018, worldwide sales of passenger cars and light commercial vehicles decreased for the first time since 2009, as carmakers sold 0.5% fewer vehicles, according to JATO Dynamics figures, based on their data of 54 top markets. Slightly over 400.000 fewer vehicle sales compared to 2017 make for a new total of 86.01 million global car sales. Passenger car and pick up sales were down 0.6% to 81.84 million and LCV sales were up 2.5 to 4.17 million vehicles. Of the major markets double digit growth was recorded by Thailand (+20%), Brazil (+14%) and Russia (+13%), the latter now a larger market than South Korea (+1,4%), while sales declined by double digits in Turkey (-35%) and Argentina (-10%) as these two countries battled economic downturns. But small declines in Europe, United States, and most significantly China had a great impact on global car sales. India on the other hand set a fourth consecutive annual sales record and finally surpassed Germany to become the world’s fourth largest car market. The fastest growing segment worldwide was that of EVs, which increased by more than 73% to over 1.2 million sales.

Disclaimer: this total excludes some major markets like Iran, the Middle East and Magreb countries, Pakistan, Philippines and a few South American countries. Still, this should give a reasonably accurate picture of the global car market last year. Our own database of 189 countries shows a total of 92.9 million worldwide car sales, an decrease of 0.3%. You can find sales records from 2005-2017 for each of these 189 countries in our Car sales by country section or by using the Worldwide Car Sales Data search box at the top right hand corner of our webpages. You can also find historic sales by brand and model in Europe, US and China of almost every car sold in those markets, monthly analyses of brand and model sales for these three markets as well as quarterly segment analyses for Europe and US. Please get in touch with us if you need more detailed data or an analysis of any car market worldwide for your business.

Disclaimer: this total excludes some major markets like Iran, the Middle East and Magreb countries, Pakistan, Philippines and a few South American countries. Still, this should give a reasonably accurate picture of the global car market last year. Our own database of 189 countries shows a total of 92.9 million worldwide car sales, an decrease of 0.3%. You can find sales records from 2005-2017 for each of these 189 countries in our Car sales by country section or by using the Worldwide Car Sales Data search box at the top right hand corner of our webpages. You can also find historic sales by brand and model in Europe, US and China of almost every car sold in those markets, monthly analyses of brand and model sales for these three markets as well as quarterly segment analyses for Europe and US. Please get in touch with us if you need more detailed data or an analysis of any car market worldwide for your business.

Worldwide car sales by region

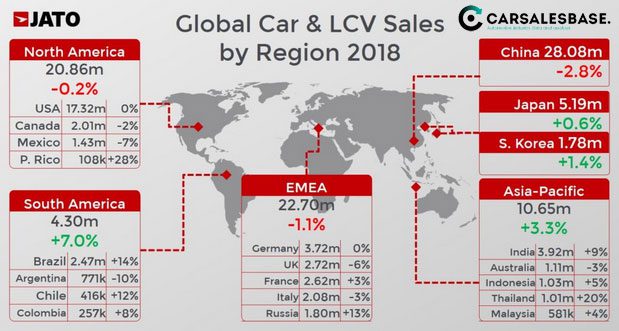

China remains the largest single market with 28.08 million sales despite showing its first slowdown in sales in more than a decade, at -2.8%. It still accounts for almost one every three car sales in the world. Car sales in the EMEA region were down 1.1% to 22.7 million with Germany as the biggest market stable at 3.72 million and Russia showing double digit growth for the second consecutive year after four years of slumping sales. The UK remains an uncertainty for the region, as well as Turkey with its unstable economy. North American car sales decreased 0.2% to 20.86 million vehicles as sales declined 2% in Canada after a record year (but still above 2 million for the second year ever), and 7% in Mexico (a second annual decline after two record years in 2015 and 2016). Sales in the Asia Pacific region excluding China, Japan and South Korea were up 3.3% to 10.65 million, boosted by Thailand and India, but also thanks to strong sales in Indonesia (+5%). Australian car sales were down 3% after setting sales records for three consecutive years. Japan was up 0.6% to 5,19 million (of which just over 300.000 non-Japanese brands) while South Korea was up 1,4% to 1,78 million. The South America region was the most dynamic again, recovering from its crisis with a 7% improvement in car sales to 4.3 million, held back by a crisis in Argentina. Of the three largest markets in the region Brazil grew by 14% to 2.47 million, Argentinian car sales declined by 10% to 771,000 but Chile was up 12% to 416,000 (of which Chinese brands hold almost 13% share as their sales were up 45% on 2017). The biggest market not included in the JATO figures is Iran with a 32.9% decline to 959,000 car sales as imports were once again restricted due to reinstalled embargoes. Sales in the GCC (Gulf Coast Council) markets were also down, by 15% to 902,000 sales.

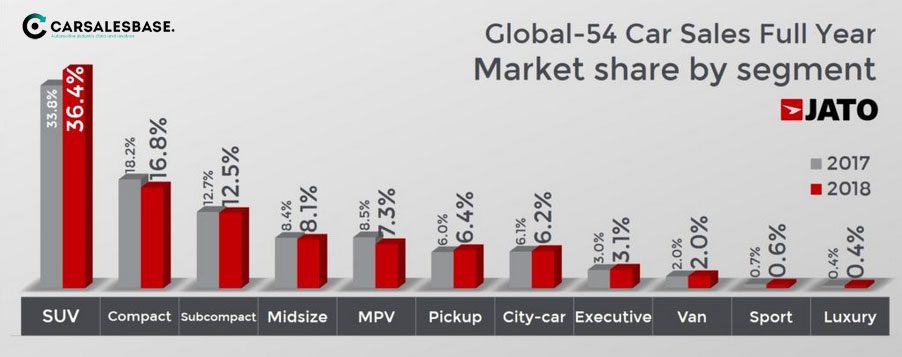

Worldwide car sales by segment

SUV and crossover sales were up 6.8% in 2018 to a record 29.77 million as they reached a new record market share at 36.4% of the total passenger car market, up 2.6 percentage points. This is an additional 1.9 million sales on 2017 and this growth is despite slowing overall markets in China, US and Europe. However, the single digit increase of 2018 follows double digit growth percentages in the three previous years, with worldwide SUV sales up 21% in 2015, up 22% in 2016 and up 12.8% in 2017. But there’ss till plenty of growth in this type of vehicle, as their share in markets like Japan (13%), Latin America (22%) and India (23%) is still below 25%, while it’s above 40% in markets like Russia (46%), USA (45%), Canada (43%) and China (42%). The latter is also the largest market for SUVs worldwide, with over 10.3 million sales or almost 35% of global SUV sales, despite a 3% decline on 2017. The following 9 largest countries in terms of SUV sales all saw increases, of which 7 by double digits. The USA (7.7 million, +10%), Germany (975,000, +15%) and UK (900,000, +11%) the largest, and Russia (767,000) and Italy (720,000) the fastest growing in the top-10 markets, both seeing their crossover sales increase by 23%. Compact SUVs (C-segment, Volkswagen Tiguan) accounted for almost 41% of total SUV sales, up 7% to 12.24 million sales with Hyundai-Kia as the world’s largest producer. Midsized SUVs (D-segment, Nissan Rogue/X-Trail) were up 3% to 7.26 million sales with Renault-Nissan as the major manufacturer, as it is in the crossover/SUV segment overall. Renault-Nissan also leads the small crossover segment (B-segment, Renault Captur), up 13% to 6.58 million sales, but Hyundai-Kia and VW Group are the fastest growing in that segment. Large SUV (E-segment, Ford Explorer) sales were up 2% to 3.68 million, with General Motors as the elephant in the room.

The continued rise of crossovers and SUVs obviously affects other segments, with MPVs suffering the most, down 14% to 6 million sales. In other words: 1 million fewer MPV sales worldwide, as they lost volume in just about every market. Only in Indonesia MPVs remain popular, with a 37% share of that market (430,000 sales) and the entire top-4 best sellers. However, also in this growing market MPVs lost volume by double digits. Compact car sales decreased 8% in 2018 and the segment now accounts for 16.8% of the total market, down 1,4 percentage points on 2017. The world has bought more midsized cars in 2018 than MPVS, even though the midsized segment loses 0,3 percentage points of share and is struggling in the US and Europe. As one of the few mainstream car segments to grow their share in 2018, pickups outsold city car/minicar/kei cars thanks to 5% growth to 5.2 million sales, as they now hold 6.4% of the global car market. Half of those sales come from the US, but growth in 2018 came from Thailand (the world’s major producer of midsized pickups) and Brazil.

Worldwide car sales by manufacturer

Please note the manufacturer data comes from different sources than JATO and therefore may differ from the brand and model data below.

Volkswagen Group sold the most passenger cars and LCVs in 2018, with a 2% increase to 10.8 million sales, excluding Heavy Commercial Vehicles and buses. Toyota Group was 2nd with 10.4 million sales, up 1.2%, and Renault-Nissan was third with 10.3 million sales, up 0.9%. General Motors saw its sales decline 4% to 8.6 million cars, while Hyundai-Kia sales were up 1.6% to 7.4 million, as it recovers from its huge declines in China in 2017. Ford was the big loser among manufacturers, with sales down 10.4% to 5.6 million, while Honda lost 0.6% to 5.2 million, FCA down 0.2% to 4.8 million and PSA down 3.8% to 4.1 million, due to struggles in China. Suzuki saw its sales increase 5% to 3 million thanks to a growing Indian market, where it holds more than 50% share. Daimler remains the world’s largest luxury car manufacturer with sales up 0.6% to 2.7 million, just ahead of BMW Group with a 1.8% gain to 2.5 million sales. Geely Group remains the largest Chinese manufacturer and the fastest growing in the top-15 with sales up 15.2% to 2.2 million. The fastest growing in the top-20 is SAIC Motor with a 31.2% gain to 900,000 sales of its proprietary brands (but a production that’s a multitude of this thanks to Joint Ventures with General Motors and Volkswagen to produce their vehicles for the Chinese market. Despite a fast declining market in Iran as mentioned above, local producer Saipa remains unaffected with sales up 1.8% to 433,000, giving it a #25 spot among manufacturers, just behind BYD and GAC Group.

Volkswagen Group sold the most passenger cars and LCVs in 2018, with a 2% increase to 10.8 million sales, excluding Heavy Commercial Vehicles and buses. Toyota Group was 2nd with 10.4 million sales, up 1.2%, and Renault-Nissan was third with 10.3 million sales, up 0.9%. General Motors saw its sales decline 4% to 8.6 million cars, while Hyundai-Kia sales were up 1.6% to 7.4 million, as it recovers from its huge declines in China in 2017. Ford was the big loser among manufacturers, with sales down 10.4% to 5.6 million, while Honda lost 0.6% to 5.2 million, FCA down 0.2% to 4.8 million and PSA down 3.8% to 4.1 million, due to struggles in China. Suzuki saw its sales increase 5% to 3 million thanks to a growing Indian market, where it holds more than 50% share. Daimler remains the world’s largest luxury car manufacturer with sales up 0.6% to 2.7 million, just ahead of BMW Group with a 1.8% gain to 2.5 million sales. Geely Group remains the largest Chinese manufacturer and the fastest growing in the top-15 with sales up 15.2% to 2.2 million. The fastest growing in the top-20 is SAIC Motor with a 31.2% gain to 900,000 sales of its proprietary brands (but a production that’s a multitude of this thanks to Joint Ventures with General Motors and Volkswagen to produce their vehicles for the Chinese market. Despite a fast declining market in Iran as mentioned above, local producer Saipa remains unaffected with sales up 1.8% to 433,000, giving it a #25 spot among manufacturers, just behind BYD and GAC Group.

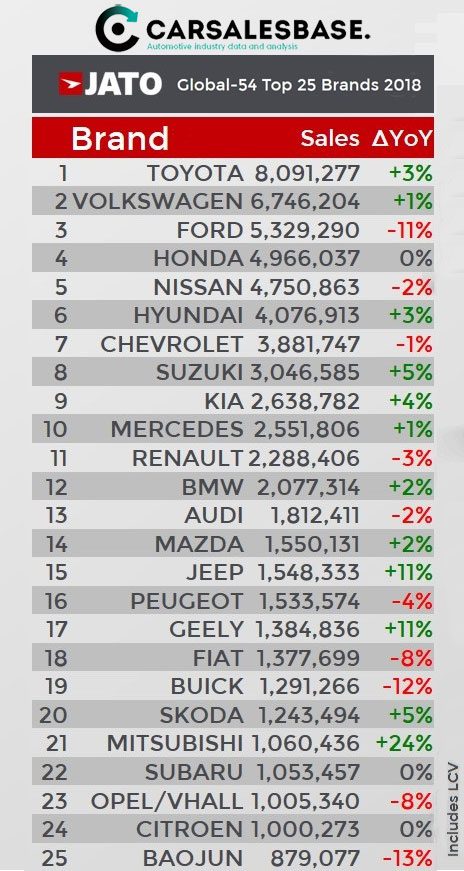

Worldwide car sales by brand

Toyota maintains its position as the best selling car brand worldwide with a margin of more than 1.3 million sales over Volkswagen, while Ford, Nissan and Chevrolet were the only brands in the top-10 to see their sales decrease in 2018. In fact, Ford was the big loser in the top-10 with an 11% decline in sales, mostly due to big declines in China (-54%). Honda sales were stable in 2018, managing to distance Nissan, which saw its sales decline by 2% due to a slowdown in the US (-6.5%). After a harsh 2017, Hyundai slightly recovers witha 3% gain back above 4 million. Suzuki tops 3 million sales for the first time while Kia also recovers after a double digit decline in 2017, with a 4% increase to pass Mercedes-Benz. Renault loses 3% and BMW distances Audi as the former wins 2% and the latter loses 2% on weak sales in Europe (-13.4%). Mazda gains two spots to #14 despite just a small 2% gain, as Peugeot (-4%) and Fiat (-8%) are struggling, the latter mainly because of Europe (-9.3%) but also Turkey (-41.6%) and Argentina (-11.6%). Jeep does one better and gains three places thanks to an 11% gain to enter the top-15, also passing Buick, down 12%. Geely also gains 2 places thanks to Fiat and Buick, and is now 17th in the brands ranking, helped by sales up 11%. Skoda keeps growing steadily, up 5% for the second consecutive year, but stays in 20th place, now with Mitsubishi as its nearest rival, re-entering the top-25 with sales up 24% to above 1 million (+84% in Indonesia, +23% in Europe, +21.3% in Thailand, +17.5% in China and +14.5% in the US). Mitsubishi lands just ahead of Subaru, which sees stable sales. Opel/Vauxhall continues to shrink as PSA is lowering fleet sales, discounts and clearing inventory for the brand, which made its first profit in a few decades last year. Citroën sees stable sales, and Baojun tumbles 3 places in the ranking to the final spot in the top-25 with a 13% decline. Mitsubishi’s return to the ranking knocks out Wuling, which was in 25th place last year.

Toyota maintains its position as the best selling car brand worldwide with a margin of more than 1.3 million sales over Volkswagen, while Ford, Nissan and Chevrolet were the only brands in the top-10 to see their sales decrease in 2018. In fact, Ford was the big loser in the top-10 with an 11% decline in sales, mostly due to big declines in China (-54%). Honda sales were stable in 2018, managing to distance Nissan, which saw its sales decline by 2% due to a slowdown in the US (-6.5%). After a harsh 2017, Hyundai slightly recovers witha 3% gain back above 4 million. Suzuki tops 3 million sales for the first time while Kia also recovers after a double digit decline in 2017, with a 4% increase to pass Mercedes-Benz. Renault loses 3% and BMW distances Audi as the former wins 2% and the latter loses 2% on weak sales in Europe (-13.4%). Mazda gains two spots to #14 despite just a small 2% gain, as Peugeot (-4%) and Fiat (-8%) are struggling, the latter mainly because of Europe (-9.3%) but also Turkey (-41.6%) and Argentina (-11.6%). Jeep does one better and gains three places thanks to an 11% gain to enter the top-15, also passing Buick, down 12%. Geely also gains 2 places thanks to Fiat and Buick, and is now 17th in the brands ranking, helped by sales up 11%. Skoda keeps growing steadily, up 5% for the second consecutive year, but stays in 20th place, now with Mitsubishi as its nearest rival, re-entering the top-25 with sales up 24% to above 1 million (+84% in Indonesia, +23% in Europe, +21.3% in Thailand, +17.5% in China and +14.5% in the US). Mitsubishi lands just ahead of Subaru, which sees stable sales. Opel/Vauxhall continues to shrink as PSA is lowering fleet sales, discounts and clearing inventory for the brand, which made its first profit in a few decades last year. Citroën sees stable sales, and Baojun tumbles 3 places in the ranking to the final spot in the top-25 with a 13% decline. Mitsubishi’s return to the ranking knocks out Wuling, which was in 25th place last year.

PSA increasingly depends on Europe due to tumbling Chinese sales, a stop of deliveries to Iran and the acquisition of Opel, which was not allowed to export much outside of Europe under GM. The French manufacturer now sells nearly 69% of its cars within Europe, with Opel/Vauxhall at 87.5%, Peugeot at 62.8% and Citroën at 59%. China now only accounts for 7.2% of PSA sales, down from 10.6% in 2017. South America accounts for most of the remainder. PSA is planning a return to the US market with Peugeot in the next decade, but that will take time to become significant. Buick sells 81.9% of its cars in China, with the remainder in the US. Subaru is dependent on the US market for 68% of its sales, compared to just 14% for the Japanese market, Jeep gets 62.9% of its sales from the US with another 10.7% from Europe. Suzuki depends on India for 56.8% of its sales with Japan accounting for another 23.5% and Europe for 8%. The brand pulled out of the US market in 2012 and announced a withdrawal from China in 2018. Of course the Chinese brands are the most extreme example of dependency on a single market, with Geely exporting just a few percent of its annual volume, and Baojun doesn’t export at all, at least not under its own name. Some of its models are sold under the Wuling name in Indonesia and are planned to be sold under the Chevrolet name in India. In contrast, Honda is more balanced with 29% of sales in US, another 28.5% in China, but just 2.7% in Europe. Volkswagen sells 46.5% in China, 25.5% in Europe, but just 5.2% in the US. Skoda sells 56.3% in Europe and 28.3% in China. Ford sells 44.7% in the US, 19% in Europe and 17% in China. While relatively small, Mitsubishi is perhaps the most balanced of them all, selling 13.5% in Indonesia, 13.3% in China, 13.1% in Europe, 11.1% in the US, 9.9% in Japan and 8% in Thailand.

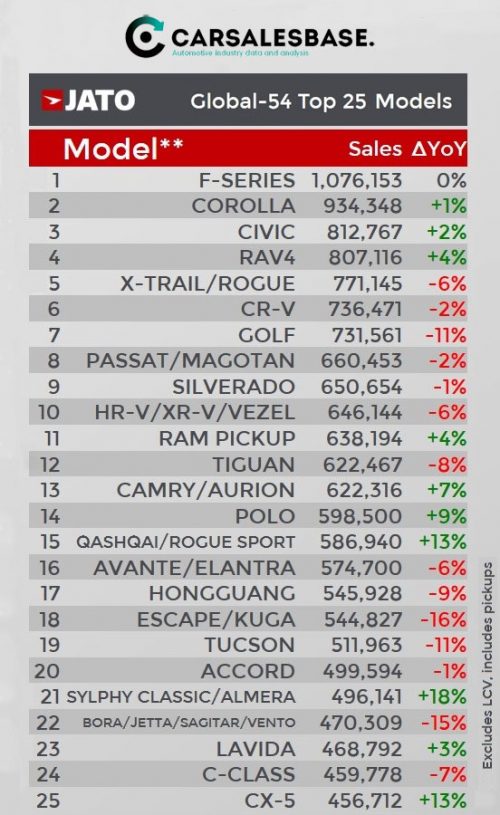

Worldwide car sales by model

Unsurprisingly, the Ford F-Series was once again the world’s best selling nameplate and it topped 1 million sales for the second year ever as the model sold just 3.000 additional units in 2018. The F-Series by itself outsold every brand outside of the top-20 brands ranking.The US accounts for 84.5% of sales for the F-Series, with Canada taking another 13.5% and Mexico 1.4%, leaving just 0.6% for outside North America. The Toyota Corolla is up 1% and holds on to its #2 spot as last year’s #3 Volkswagen Golf tumbles down the ranking to #7 with sales down 11%, due to the diesel crisis in Europe and for having the next generation coming up in 2019. The Honda Civic makes sure that there are still two car models in the top-3 with sales up 2% thanks to robust sales in China (+25%) and passing both the Golf and the X-Trail/Rogue. JATO appears to be confused about the Nissan Sylphy/Sentra here, because the Sylphy nameplate model sold 475,000 in China (although this includes both the new generation and the previous, called Sylphy Classic) and another 213,000 in the US under the Sentra name, combining for 688,000 sales. Add another 36,000 sales in Mexico, 12,500 in Canada, and the Sentra/Sylphy is already in the top-6. JATO does combine the Sylphy Classic with the Almera in 21st place, but the Almera is also known as Versa sedan in North America, and Sunny in China and other markets. Looking at its reported numbers by JATO, it seems like they’ve added the Sentra/Sylphy classic to Sunny/Versa figures, which seems a bit strange to me.

Unsurprisingly, the Ford F-Series was once again the world’s best selling nameplate and it topped 1 million sales for the second year ever as the model sold just 3.000 additional units in 2018. The F-Series by itself outsold every brand outside of the top-20 brands ranking.The US accounts for 84.5% of sales for the F-Series, with Canada taking another 13.5% and Mexico 1.4%, leaving just 0.6% for outside North America. The Toyota Corolla is up 1% and holds on to its #2 spot as last year’s #3 Volkswagen Golf tumbles down the ranking to #7 with sales down 11%, due to the diesel crisis in Europe and for having the next generation coming up in 2019. The Honda Civic makes sure that there are still two car models in the top-3 with sales up 2% thanks to robust sales in China (+25%) and passing both the Golf and the X-Trail/Rogue. JATO appears to be confused about the Nissan Sylphy/Sentra here, because the Sylphy nameplate model sold 475,000 in China (although this includes both the new generation and the previous, called Sylphy Classic) and another 213,000 in the US under the Sentra name, combining for 688,000 sales. Add another 36,000 sales in Mexico, 12,500 in Canada, and the Sentra/Sylphy is already in the top-6. JATO does combine the Sylphy Classic with the Almera in 21st place, but the Almera is also known as Versa sedan in North America, and Sunny in China and other markets. Looking at its reported numbers by JATO, it seems like they’ve added the Sentra/Sylphy classic to Sunny/Versa figures, which seems a bit strange to me.

The X-Trail/Rogue latter is no longer the world’s best selling crossover with sales down 6% to fall behind the Toyota RAV4, up 4% even though it was in the final year before its new generation. The Honda CR-V was also in model-change mode and loses 2% to remain behind the X-Trail. The latter is strongest in the US (412,000 sales including the Rogue Sport/Qashqai, which they don’t split out there. But the latter is just a small percentage of total Rogue sales), then China (208,000), and Europe is just a small market (48,000). The RAV4 is similarly spread, with the US accounting for 427,000 sales, China for 144,000 sales and Europe for 69,000, which leaves about 20% of total sales for the rest of the world. And similarly, the CR-V sells 379,000 in the US, 143,000 in China and just 28,500 in Europe, leaving about 25% for the rest of the world. The Nissan Qashqai is the fastest growing model in the top-15 thanks to the addition of the Rogue Sport for the US. It is up 7 places on 2017. The Volkswagen Polo jumps 5 places to #14 thanks to a 9% gain from the new generation. The RAM Pickup wins 3 spots to #11 with sales up 4% to close in to its arch rival Chevrolet Silverado, down 1% in 9th place, just 12,500 sales ahead. In the US, the Silverado outsells the RAM by 48,600 units, but in Canada the RAM is 29,750 ahead of the Chevy. The RAM is also relatively popular through grey market imports in Europe, where none of these large behemoths is sold through official channels.

The two versions of the Volkswagen Passat are up 2 places to #8 but down 2%, yet remain the best selling midsized model, ahead of the Toyota Camry at #13, up 7%. The Passat sells best in Europe (154,000) and China (229,000 Magotan/Euro-Passat plus 179,000 N-A Passat), and is virtually non-existent in the US (41,400 sales), leaving just 57,000 for the rest of the world. The Camry excells in the US (343,000), does alright in China (163,000), but is not (yet) sold in Europe. That means 116,000 units of the Camry and Auris were sold in the rest of the world. The Accord, no longer sold in Europe either, sees stable sales (-1%) and was sold 291,000 times in the US and 176,000 times in China, leaving just 43,000 for the rest of the world.

After jumping a whopping 34% in 2017, the Volkswagen Tiguan is down 8% in 2018, despite having full-year availability of the longer Allspace version. The Ford Escape/Kuga is down 16% because of slumping sales in China (-60,000 sales) and the US (-36,000 sales), with European sales stable. It does remain ahead of the Hyundai Tucson, down 11% despite a 24% gain in US sales, as its China sales were down 57.7% because of the updated ix35, which is a previous generation version of that car, sold for a much lower price. The Wuling Hongguang is now the only model from a Chinese manufacturer in the top-25 of best selling models worldwide, as the Haval H6 has been knocked out of the ranking by the Mazda CX-5. The Mercedes-Benz C-Class remains the world’s best selling luxury car at #24 despite losing 7% in 2018. JATO also reports 2018 was a good year for the Kia Sportage, Chevrolet Equinox, Toyota Hilux, Jeep Compass, Toyota C-HR, Hyundai Creta, Ford Ecosport, Jeep Wrangler, Toyota Tacoma, Chevrolet Cavalier, Mercedes A-Class and Suzuki D-Zire And even further down the rankings, it was also a good year for the Hyundai Kona, Volkswagen T-Roc, Changan CS55, Volkswagen Atlas/Teramont, Baojun 360, Hyundai ix35, BYD Song Max, Tesla Model 3, Skoda Karoq, Geely Vision X3, Baojun 530, Buick Regal, Citroen C3 Aircross and Peugeot 5008 SUV.