Honda has confirmed rumors that the brand has no plans to develop a replacement to the European version of its Accord midsized sedan and station when the current eighth generation reaches the end of its life cycle. This shouldn’t come as a surprise considering the model’s sales have been decimated in the last decade. In 2004, Honda sold a record of 48.346 Accords in Europe, but that figure has dwindled more than 90% to a mere 4.467 units last year, while 2014 sales are off another 35% year to date.

Honda has confirmed rumors that the brand has no plans to develop a replacement to the European version of its Accord midsized sedan and station when the current eighth generation reaches the end of its life cycle. This shouldn’t come as a surprise considering the model’s sales have been decimated in the last decade. In 2004, Honda sold a record of 48.346 Accords in Europe, but that figure has dwindled more than 90% to a mere 4.467 units last year, while 2014 sales are off another 35% year to date.

The addition of Honda’s first in-house developed diesel engine in 2004 gave the model a much-needed boost, as more than half of all midsized cars sold in Europe are equipped with an oil burner, but it couldn’t save the Accord. Despite its reputation for undisputed quality, Honda’s midsized car was considered too expensive by most buyers, as Japanese production forced the brand to price the Accord against the premium offerings in the highly competitive midsized segment.

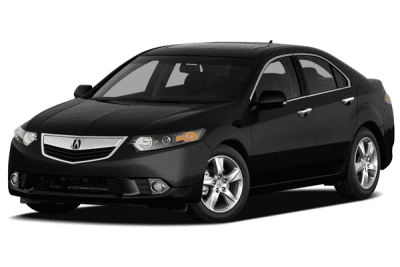

The addition of Honda’s first in-house developed diesel engine in 2004 gave the model a much-needed boost, as more than half of all midsized cars sold in Europe are equipped with an oil burner, but it couldn’t save the Accord. Despite its reputation for undisputed quality, Honda’s midsized car was considered too expensive by most buyers, as Japanese production forced the brand to price the Accord against the premium offerings in the highly competitive midsized segment. The Japanese brand had been able to achieve favorable economies of scale by selling the European Accord alongside the larger US Accord in overseas markets like China (named Spirior) and Australia (named Euro), and as the Acura TSX in the USA. But with the TSX replaced by the TLX sedan, and the new generation Spirior becoming a China-only standalone model as well, there’s little volume left for Honda to justify the development of a ninth generation Accord just for the European market. And the US Accord won’t fit European tastes enough to make that car a competitive player in the continent.

The Japanese brand had been able to achieve favorable economies of scale by selling the European Accord alongside the larger US Accord in overseas markets like China (named Spirior) and Australia (named Euro), and as the Acura TSX in the USA. But with the TSX replaced by the TLX sedan, and the new generation Spirior becoming a China-only standalone model as well, there’s little volume left for Honda to justify the development of a ninth generation Accord just for the European market. And the US Accord won’t fit European tastes enough to make that car a competitive player in the continent.

With the demise of the Accord, Honda joins Seat and Suzuki who have also decided to leave the European midsized segment this year. But while the Exeo and Kizashi have been axed after just one generation due to slow sales, the Accord has been in Europe since 1976 and has enjoyed relative success, for example making up almost a quarter of total Honda brand sales in the year 2000. The main reason for this exodus of models from the segment is the negative trend that’s plagued the midsize segment for years, especially the non-premium offerings. Between 2001 and 2013, the segment has lost two thirds of its volume, that means the automakers are selling over a million fewer midsized cars a year than twelve years ago. Some of that volume is lost because of lower car sales in general, but most buyers have switched to either compact cars or crossovers.

With the demise of the Accord, Honda joins Seat and Suzuki who have also decided to leave the European midsized segment this year. But while the Exeo and Kizashi have been axed after just one generation due to slow sales, the Accord has been in Europe since 1976 and has enjoyed relative success, for example making up almost a quarter of total Honda brand sales in the year 2000. The main reason for this exodus of models from the segment is the negative trend that’s plagued the midsize segment for years, especially the non-premium offerings. Between 2001 and 2013, the segment has lost two thirds of its volume, that means the automakers are selling over a million fewer midsized cars a year than twelve years ago. Some of that volume is lost because of lower car sales in general, but most buyers have switched to either compact cars or crossovers.

Nissan has left the segment in 2007 already when they killed the Primera (and the Almera compact as well) in favor of the Qashqai midsized crossover, and they never looked back. The Qashqai by itself has sold over 1 million units in Europe in the five years from 2009 until 2013, which is considerably more than the 880.000 Almeras and Primeras the brand sold in the same five years a decade earlier. Perhaps Honda should’ve used a similar strategy, considering the CR-V crossover has consistently outsold the Accord every year since 2005 and has sold more than twice as many units since.

The Accord is not the only Honda model that hasn’t been able to keep up with consumer preferences in the European market lately, as both hybrid-only models Insight and CR-V have each recorded less than 500 sales this year until August and look set to be pulled from the market as well. Not unsurprisingly, these two models are also produced in Japan and have suffered from unfavorable exchange rates. That leaves Honda with just three models, all built in Honda’s Swindon, UK plant: the Jazz subcompact (also known as the Fit in other markets), the Civic compact hatchback and station wagon (which is different from the US Civic as well) and the CR-V midsized crossover. The HR-V compact crossover (also known as Vezel in other markets) will be added to the line-up in 2015, together with the next generation Jazz.

The Accord is not the only Honda model that hasn’t been able to keep up with consumer preferences in the European market lately, as both hybrid-only models Insight and CR-V have each recorded less than 500 sales this year until August and look set to be pulled from the market as well. Not unsurprisingly, these two models are also produced in Japan and have suffered from unfavorable exchange rates. That leaves Honda with just three models, all built in Honda’s Swindon, UK plant: the Jazz subcompact (also known as the Fit in other markets), the Civic compact hatchback and station wagon (which is different from the US Civic as well) and the CR-V midsized crossover. The HR-V compact crossover (also known as Vezel in other markets) will be added to the line-up in 2015, together with the next generation Jazz.

If Honda is able to keep the pricing of these smaller cars competitive, I’m sure the brand still has a future in Europe, as the Japanese deserve to be more than just an also-ran and I think they really do offer something that others don’t. But if they’re unable to convince enough car shoppers to put their vehicles on their shopping list, I’m afraid they could be the next brand not to survive the ongoing crisis in the European car market.