After revealing the Tesla Model 3 last Thursday, Elon Musk tweeted the company had received 276.000 pre-orders by the end of Saturday. (UPDATE: THE FIRST-WEEK TOTAL NOW STANDS AT 325.000). That would translate to more than $10 billion in revenue if all of those orders end up being delivered. In less than 72 hours, it also almost fulfills the company’s full-year goal of 300.000 Model 3 sales, in a total of half a million annual Tesla sales by 2020. Filling the order base this quickly for a model for which not a lot of specs have been released so far and which won’t start deliveries for at least another year-and-a-half is an amazing performance from the start-up manufacturer by any measure. And if the rebound of its stock price continues, Tesla’s market capitalization will close in on that of General Motors again. However, FCA chairman Sergio Marchionne has been quoted last year that car makers need to sell at least 5,5 to 6 million cars per year in order to survive in the long run. And despite its quick rise out of nowhere as a challenger of the establishment, Tesla is still a long way from selling that kind of volume worldwide, and to reach it would require vast investment in additional models and in expansion of the distribution channel. So assuming Marchionne is right, what’s Elon Musk’s strategy for building Tesla into a long-term viable auto maker?

After revealing the Tesla Model 3 last Thursday, Elon Musk tweeted the company had received 276.000 pre-orders by the end of Saturday. (UPDATE: THE FIRST-WEEK TOTAL NOW STANDS AT 325.000). That would translate to more than $10 billion in revenue if all of those orders end up being delivered. In less than 72 hours, it also almost fulfills the company’s full-year goal of 300.000 Model 3 sales, in a total of half a million annual Tesla sales by 2020. Filling the order base this quickly for a model for which not a lot of specs have been released so far and which won’t start deliveries for at least another year-and-a-half is an amazing performance from the start-up manufacturer by any measure. And if the rebound of its stock price continues, Tesla’s market capitalization will close in on that of General Motors again. However, FCA chairman Sergio Marchionne has been quoted last year that car makers need to sell at least 5,5 to 6 million cars per year in order to survive in the long run. And despite its quick rise out of nowhere as a challenger of the establishment, Tesla is still a long way from selling that kind of volume worldwide, and to reach it would require vast investment in additional models and in expansion of the distribution channel. So assuming Marchionne is right, what’s Elon Musk’s strategy for building Tesla into a long-term viable auto maker?

Let’s just drop the bomb right here: I don’t think he has such a strategy, because I believe he thinks of himself more as the boss of a tech company that happens to produce cars than as the boss of a car company in the traditional sense, like General Motors or Ford. For tech companies, making money in their first few years is much less relevant than achieving a certain network size and scale so their new technology can claim to have set the standard for others in that market to follow. Elon Musk’s vision for Tesla therefore is probably to set the technology standard upon which all future electric cars can be built, using his batteries and perhaps even his platform. That vision is reflected in the structure of the company, the design of the cars, the size of their battery factory, their decision to give away the patents to their technology and their Supercharger network and in their ability to do over-the-air software upgrades on their cars.

Let’s just drop the bomb right here: I don’t think he has such a strategy, because I believe he thinks of himself more as the boss of a tech company that happens to produce cars than as the boss of a car company in the traditional sense, like General Motors or Ford. For tech companies, making money in their first few years is much less relevant than achieving a certain network size and scale so their new technology can claim to have set the standard for others in that market to follow. Elon Musk’s vision for Tesla therefore is probably to set the technology standard upon which all future electric cars can be built, using his batteries and perhaps even his platform. That vision is reflected in the structure of the company, the design of the cars, the size of their battery factory, their decision to give away the patents to their technology and their Supercharger network and in their ability to do over-the-air software upgrades on their cars.

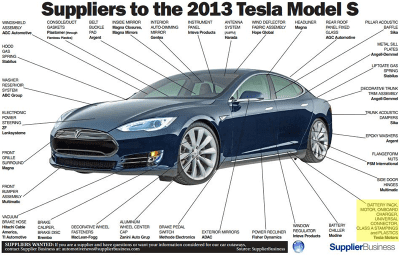

Tesla company structure

Tesla is one of the most vertically integrated car companies in the world, especially considering its size. Not only does it keep all of its sales in-house as opposed to the franchise system used by just about every other major car maker, more importantly is that Tesla has developed most of its core technology in-house and relies less on external suppliers than most of the other major automakers, who’d sometimes better be described as auto parts assemblers. While the rest of the automotive industry depends heavily on outsourced technology from suppliers like Bosch, Magna, Continental, Denso, ZF and Johnson Controls, Tesla has made sure it produces the batteries, electric motor, on-board charger and the electronics themselves in their Gigafactory in Nevada (click on the picture to enlarge). That means it controls how the development of this technology continues. It also means they can sell or license the technology to other auto makers or especially new entrants who don’t have the resources to develop this on their own, to then design their own body, interior and software on this platform. For example Apple and Google are working on their own cars, trying to disrupt the established order, and they could save a ton of development time and cost by using the existing Tesla platform and batteries to build their own cars, leaving them to focus on what differentiates them from their competition: in Apple’s case the design, marketing and the user interface, in Google’s case the autonomous technology and connectivity features with its Android operating system. It would lower the entry barrier for non-automakers to start producing electric cars, so others may follow suit. Remember the “Intel inside” stickers on your new computer or laptop a few years ago? Tesla could play the same card with EVs to achieve the desired scale without having to build and sell millions of cars themselves.

Tesla car designs

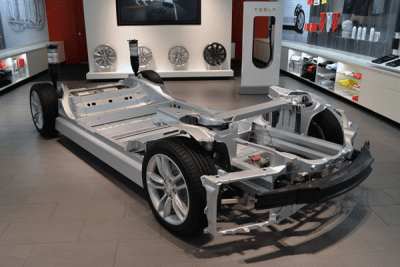

Even their cars are designed to suit that strategy. All modern sedans and most of the current crossover are all unibody designs, because it saves weight and improves handling as opposed to a body-on-frame construction which used to underpin cars a few decades ago and is still used on trucks and some SUVs and offroaders. Tesla uses a similar construction for its current line-up, but that doesn’t mean it’s old-fashioned technology. The separate chassis allows for a low floor which incorporates the battery pack and also contains the electric motor(s) and the suspension, and allows for different bodies to be “bolted on” to the chassis. That means it could supply the platforms including the battery packs and electronic controls to other auto makers who can then design their own bodies onto that platform, as described above. This is much easier for a body-on-frame platform than for a unibody design, where the body is a key component in the structural rigidity of the entire car, and has a number of “hard points” that can’t simply be changed in order to provide for a different design. The Tesla platform can. It could easily be used to build a convertible, a commercial van, a pick-up truck or a sports car, you name it.

Even their cars are designed to suit that strategy. All modern sedans and most of the current crossover are all unibody designs, because it saves weight and improves handling as opposed to a body-on-frame construction which used to underpin cars a few decades ago and is still used on trucks and some SUVs and offroaders. Tesla uses a similar construction for its current line-up, but that doesn’t mean it’s old-fashioned technology. The separate chassis allows for a low floor which incorporates the battery pack and also contains the electric motor(s) and the suspension, and allows for different bodies to be “bolted on” to the chassis. That means it could supply the platforms including the battery packs and electronic controls to other auto makers who can then design their own bodies onto that platform, as described above. This is much easier for a body-on-frame platform than for a unibody design, where the body is a key component in the structural rigidity of the entire car, and has a number of “hard points” that can’t simply be changed in order to provide for a different design. The Tesla platform can. It could easily be used to build a convertible, a commercial van, a pick-up truck or a sports car, you name it.

Tesla Gigafactory

Tesla’s all-new Gigafactory in Nevada, built in partnership with Panasonic, is the world’s largest building by physical area and has a projected capacity of 35 GWh/year of battery cells as well as 50 Gigawatt-hours year of Powerpacks by 2020, enough to build half a million electric cars annually. This capacity could double by expanding the factory, and Tesla has plans to build more Gigafactories if demand exceeds expectations, it has already started scouting for locations in Japan, China and Europe. The size of the factory alone helps reduce the cost of batteries by 30%, according to Tesla, as it has an annual capacity of more than the worldwide output in 2013. Realizing that volume has the biggest influence on the price of batteries, he must have figured that the market leader has a cost advantage and could then become the dominant player in battery technology by supplying others with their batteries, creating even greater economies of scale. Rivals can either source their EV batteries from external sources at a higher price or buy them from Tesla.

Tesla’s all-new Gigafactory in Nevada, built in partnership with Panasonic, is the world’s largest building by physical area and has a projected capacity of 35 GWh/year of battery cells as well as 50 Gigawatt-hours year of Powerpacks by 2020, enough to build half a million electric cars annually. This capacity could double by expanding the factory, and Tesla has plans to build more Gigafactories if demand exceeds expectations, it has already started scouting for locations in Japan, China and Europe. The size of the factory alone helps reduce the cost of batteries by 30%, according to Tesla, as it has an annual capacity of more than the worldwide output in 2013. Realizing that volume has the biggest influence on the price of batteries, he must have figured that the market leader has a cost advantage and could then become the dominant player in battery technology by supplying others with their batteries, creating even greater economies of scale. Rivals can either source their EV batteries from external sources at a higher price or buy them from Tesla.

Patent sharing and Supercharger network

In 2014, Musk released a press statement that it would allow its technology patents to be used by anyone in good faith. One of the reasons they stated for this strategy was to “advance the development of zero emission vehicles”, claiming that an accelerated acceptance of EVs would benefit the Tesla brand as well. A nice side effect would be that other auto makers using the Tesla technology for their EVs would help establish that technology as the standard for electric cars. It would also give them access to Tesla’s network of Superchargers, again aiding that network to become the new standard for charging EVs, especially in the United States where there are still very few competing public EV charging points outside certain cities. If the Superchargers become the standard for fast-charging of electric cars, other automakers will be forced to use Tesla technology for their EVs and Tesla can then charge (no pun intended) their customers to charge their cars, recovering the costs of the implementation of the network as well. And if it kept charging free for Tesla owners, it would also have a Unique Selling Point for buying a Tesla car instead of its rivals.

In 2014, Musk released a press statement that it would allow its technology patents to be used by anyone in good faith. One of the reasons they stated for this strategy was to “advance the development of zero emission vehicles”, claiming that an accelerated acceptance of EVs would benefit the Tesla brand as well. A nice side effect would be that other auto makers using the Tesla technology for their EVs would help establish that technology as the standard for electric cars. It would also give them access to Tesla’s network of Superchargers, again aiding that network to become the new standard for charging EVs, especially in the United States where there are still very few competing public EV charging points outside certain cities. If the Superchargers become the standard for fast-charging of electric cars, other automakers will be forced to use Tesla technology for their EVs and Tesla can then charge (no pun intended) their customers to charge their cars, recovering the costs of the implementation of the network as well. And if it kept charging free for Tesla owners, it would also have a Unique Selling Point for buying a Tesla car instead of its rivals.

Over-the-air updates

Apple’s business model is not only geared towards just selling hardware (iPhones, iPads etc.), but also towards selling services like iTunes and takes a commission on apps bought by its users. Tesla may also try to use this strategy of getting users “hooked” on its hardware, and then make money from selling them additional services, of which supercharging is just one example. It already does so by charging customers to activate the “Ludicrous Mode” in the Model S. It could also do this for autonomous driving capabilities and other upgrades. Most of these have been offered free for Model S and Model X owners, but could be optional for Model 3 owners. Again, by letting other companies use its hardware, Tesla gets an even bigger pool of users to whom they can sell such services and make money even if they’ve given away the patents to the hardware.

Elon Musk must realize that despite the early success of the Model 3, the long-term outlook for Tesla as just an automobile manufacturer is a difficult business case. He has already revealed that his goal is not to become another GM or Ford, but to disrupt the industry and accelerate the acceptance of EVs. But he could achieve that goal while at the same time becoming a dominant player in that market and make more money than the mass manufacturers by leveraging his battery and platform technology to become a supplier to those other auto makers. At this moment, suppliers make more money than the auto makers themselves, simply because they add more value to the supply chain as they develop their technology in-house and sell it to multiple car makers. Tesla may sell only 500,000 cars bearing its own brand name, but its technology could be featured invisibly in millions more. It’s growing quickly to become the world’s biggest producer of electric cars, making sure it sets the standard for others to follow, its platform has the ability to underpin a number of different bodies, also from other automakers, and it has the potential capacity to build enough car batteries to supply more than its internal demand. And to top it all off, it has already released its patents, which will help its technology reach a large enough scale to become the dominant technology to set the standard for all others to follow and to create a user pool to whom it can sell additional services.

Sadly, not all auto executives understand this strategy, as Sergio Marchionne doesn’t see the business case for the Model 3 so his company Fiat Chrysler Automobiles will find itself ill-prepared for the future.