Geely Goes Electric: A Review of Geely, in the EV and Hybrid Space

This past year was a busy year for Geely, in terms of launching new electric or “electrified” cars into the market. New product launches included three “pure EVs” (i.e. electric vehicles running on batteries only), two new Plug-In-Hybrid Electric Vehicle/PHEV models, and one Mild Hybrid Electric Vehicle (regenerative braking only) model.

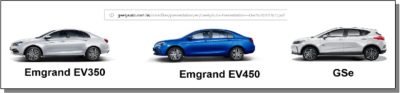

The pure EVs included two sedan models (Emgrand EV 350, and Emgrand EV 450), and one hatchback/crossover (Emgrand GSe). All three vehicles are pictured below.

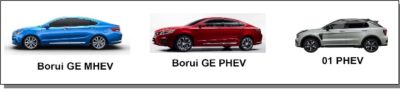

In the hybrid class, Geely launched its Borui GE sedan, both as a Plug-In-Hybrid Electric Vehicle/PHEV and as a mild hybrid/MHEV. Also pictured below is the Lynk & Co. model 01 PHEV, a product of the Geely-Volvo joint venture, which gave rise to the new brand (Lynk & Co.).

During the most recent period (2018Q4), four models constituted the bulk of Geely’s sales in the NEEV (New Energy and Electrified Vehicles) category1; the Emgrand EV, the Borui GE PHEV, Borui GE MHEV, and the Lynk & Co. 01 PHEV.

We don’t yet publish detailed sales volume data for all the models above, but Geely’s best selling EV or PHEV is the Emgrand EV with 31,853 sales in 2018, compared to 17,058 for the Borui GE PHEV. In a broader list of best selling EVs or PHEV models in China, the Emgrand ranked 13th overall. Although NEEVs are increasingly important for Geely, they still represent a small percentage of the company’s overall sales. For example, Geely’s total NEEV sales for 2019 were just over 60,000 units in total, while its overall sales volume for the same period for all vehicle types was much larger 1,387,258 units. Of these, December 2018 NEEV sales were proportionately larger, with 6,271 NEEVs sold, compared to 88,421 vehicles sold overall.

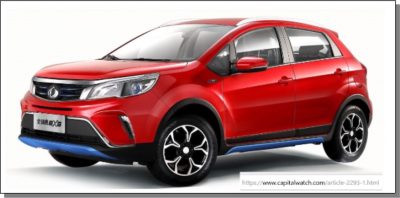

Geely’s GSe SUV (pictured below) is interesting in that it is a modification/rebuild of the conventional Emgrand GS model. The key difference is that the GSe is a pure EV powered entirely by batteries whereas the Emgrand GS is powered by a traditional Internal Combustion Engine/ICE.

The GSe was reviewed in EVObsession, some of the key highlights of that review included:

-

- A base price of 119,800 RMB, equivalent to approximately $18,740, after China’s government subsidies.

-

A driving range of 350 km (217 miles), and a 163 horsepower (120 KWh) electric motor.

A driving range of 350 km (217 miles), and a 163 horsepower (120 KWh) electric motor. - In contrast to the Emgrand GS, the interior of the GSe has a plastic knob as opposed to a gearbox, and wireless charging for one’s phone or other devices.

- – As a somewhat unique feature, the GSe includes a power source/outlet, that can be used to charge other cars or equipment.

- – An upgraded air-filter to combat China’s well-known PM 2.5 air pollution challenges.

- – Automated voice control functionality

The Lynk & Co. PHEV 01, as noted above, is an example of Geely producing and selling electric or electrified vehicles via a joint venture (JV) arrangement. Another JV, with the company Kandi, has recently produced an EV SUV, known as the EX32:

Products of the Geely-Kandi JV; are branded as “Geely Global Hawk”. Such branding is advantageous in that a large and long-established company like Geely has a much bigger name/brand recognition in China compared to a smaller company like Kandi.

The EX3 is very competitively priced w/ an after subsidies base price of approximately 76,800 RMB (equivalent to $11,300) and an “all the bells and whistles price” of about 96,800 RMB (equivalent to $14,300). Although the EX3 and Geely’s own GSe (featured earlier, above) have important differences in terms of size and other aspects, the substantially lower base price of the EX3 ($14,300 vs. $18,740) is noteworthy.

During the last three months of 2018, 2,934 EX3s were sold, while the corresponding figure for the GSe was 1,595. These sales volume data are wholesale figures, from factory to dealer, as reported by Geely to the Chinese Association of Automobile Manufacturers/CAAM. While more time will be needed to see how well the EX3 continues to sell in China, given the fourth quarter performance noted above, it would appear that the EX3 is being well received by Chinese consumers.

While China is the only market where EX3s are currently available, Kandi made news recently with its pioneering effort to enter the US market, as reported in an August 2018 article here. Kandi’s US-based subsidiary and distributor, Sportsman Country LLC, based in Texas, is currently involved in preparing for sales which mainly involves working with federal and state governments on regulatory procedures and clearances, and working with prospective dealers. Efforts to enter the US market have been hampered by the recent US government shutdown.

As recently as January 2019, the CEO of Kandi, Mr. Hu Xiaoming, was quoted in a Bloomberg article saying: “…we found that there is a market in the U.S. as consumers fancy the cars and our prices are competitive, …“Our distributor is confident about the sales prospects and we would like to give it a try.” It remains to be seen how well the EX3 will sell in the US market, and whether its main selling point, its affordability, will actually drive American buyers to take a chance on the unknown brand. Although we don’t yet know how much the EX3 will sell for, we do know that the “after subsidy cost” in China is approximately $12,800. Subsidies in the US for EVs are known to be much less generous. The “before subsidies” Manufacturer Suggested Retail Price (MSRP) of an EX3 in the US is $29,995. The federal tax credit of $7500, coupled with additional rebates at the state level will mean that the effective price of an EX3 in the US will be close to $20,000. It is difficult to find EV small SUVs currently available (or soon to be available) on the US market, with an equally affordable low price, or with specs that are similar to the EX3. A recent article, “The Cheapest Electric Cars on the Market; featured a review of thirteen relatively low-cost EVs. The review included only one EV small SUV; the 2019 Hyundai Kona EV (pictured below).

While we don’t know what other EVs potential Kandi customers might be considering, during 2019, Hyundai’s Kona EV, will likely be the most affordable small SUV EV on the American market. For that reason, the EX3 is being compared with the Kona in this context.

In short, when comparing the EX3 with the Kona it looks like consumers will have a pretty clear choice between price (savings) and performance and power. In other words, the price (MSRP) of the Hyundai Kona EV, before subsidies and rebates are expected to be approximately $37,000. Its effective price after the federal tax credit, and after state rebates should be closer to $27,000, or approximately $7,000 more than the estimated price of the EX3. On the other hand, the Kona has significantly more power, faster acceleration, and a significantly longer driving range. More specifically, the Kona is powered by a 64kWh battery pack (vs. 42kWh for the EX3) and can accelerate much faster due to its 395 n.m maximum torque (vs. 195 n.m for the EX3). The Kona’s driving range of 258 miles (415 km.) is significantly longer than the EX3’s range of 188 miles (300 km.). Lastly, the Kona requires about 9.5 hours for recharging (Level 2—240 volt), whereas the EX3 recharge takes 7.5 hours (Level 2). The Kona also has a 75kw fast-charging capacity, that allows its battery to be 80 percent DC fast charged in just 54 minutes. It is not clear whether the EX3 has a fast-charge option.

As 2019 progresses, it will be interesting to see whether the affordability of the EX3 leads to significant sales volume, either in China or the US. It is very likely that domestic sales in China will dominate total sales.

Overall, exports represent a small or even tiny percentage of Geely’s business. Similarly, Kandi (Geely’s JV partner) has had zero to negligible exports. During Jan.-Nov. 2018, of the 1,407,505 cars sold by Geely Auto., only 20,498 were exports, representing less than 2% of the total. Although New Energy and Electrified Vehicles (NEEVs) also represented a small percentage of total (less than 5%) compared to 2017, NEEV sales for 2018 were up an impressive 177%.

In addition to its attractive price, the EX3 has a number of features that should appeal to buyers, and particularly younger buyers. These include, a large 12.3-inch multimedia touch screen, blue-tooth, a one-button start, car reverse backup cameras, and an App with connectivity to the phone that allows some features and functions to be controlled or monitored remotely.

Given their high rates of growth, electric and electrified vehicles sales will continue to be a priority for Geely. In a December 2018 corporate presentation, the company explicitly stated its plans to focus on EVs, PHEVs, and MHEVs “to speed up new energy product offerings.”

Given their high rates of growth, electric and electrified vehicles sales will continue to be a priority for Geely. In a December 2018 corporate presentation, the company explicitly stated its plans to focus on EVs, PHEVs, and MHEVs “to speed up new energy product offerings.”

Geely’s capital expenditures indicate that the company is “putting its money where its mouth is.” In February 2018, Geely announced its plans to build and fund a five billion dollar New Energy Vehicle (NEV) production base in eastern China (Zhejiang Province). According to one source, a high-tech industrial park will be created, to further strengthen the company’s NEV manufacturing capacity and supply chain.

Geely is building up its production capacity in two additional China locations, Ningbo in eastern China, just south of Shanghai, and in central China’s Hubei province, in the city of Wuhan.

In August of 2018, Reuters reported on the Ningbo development highlighting that new/planned plant capacity would give the company an ability to produce an additional 250,000 “bigger sized cars.” Although that reporting did not specify the type of cars to be produced (traditional gasoline running ICE cars, or hybrids or EVs); it was reported that two assembly lines will be added. The estimated cost of one such line was approximately $498.31M (3.4 billion RMB).

The plant in Wuhan will produce a variety of vehicle types; gasoline, hybrid, and electric. In financial terms, the investment approved was for $1.3 billion (9 billion RMB ). The expected total capacity of the Wuhan facility is 150,000 units/vehicles per year.

Although Geely’s overall production capacity is still heavily tilted towards the production of traditional ICE vehicles, based on the information above, Geely appears to be making an equal or perhaps even greater investment in New Energy Vehicles/NEVs (hybrids and EVs) based on large capital expenditures announced or reported during 2018. This prioritization on electric and electrified cars is consistent with Geely’s longer-term goals and past company statements.

For a complete list of sources and references used in this article; click here.

Full disclosure: I currently own shares in Nasdaq listed Kandi (ticker symbol kndi), and am long.

1Geely’s NEEV category includes electric vehicles (EVs), hybrid electric vehicles (HEVs), mild hybrid electric vehicles (MHEVs) and plug-in hybrid electric vehicles (PHEVs).

2 “Geely” is used to describe more than one corporate entity. Depending on context, “Geely” can refer to Geely Automobile Holdings, or the Geely-Kandi joint venture (JV), a separate entity which is partly owned by the Zhejiang Geely Holding Group. For a helpful diagram of the larger Zhejiang Geely Holding Group, and its numerous subsidiary companies, click here.