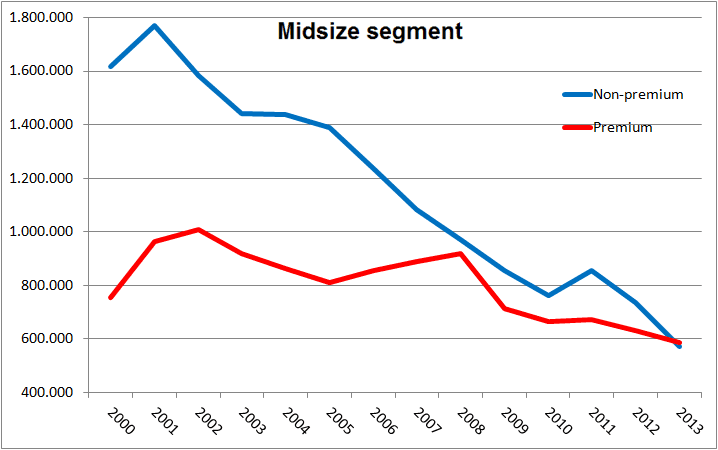

The midsized car segment in Europe has been in a deep crisis for over a decade, but the bottom of the steep slope appears to be in sight. After total segment sales of premium and non-premium models had dropped from a high of over 2.7 million vehicles in 2001 to less than 1.2 million in 2013, the decline seems to have stabilized in 2014 with sales year to date down less than 0,2% on last year.

The decline is not evenly shared among premium and non-premium models. In fact, non-premium models outsold their premium rivals by at least a 2-to-1 ratio until the year 2000, but especially the German Big 3 have made great inroads ever since. As a result of this strong performance, in 2013 for the first time ever, premium midsized cars outsold their non-premium rivals in Europe and they’re taking an even greater lead in 2014.

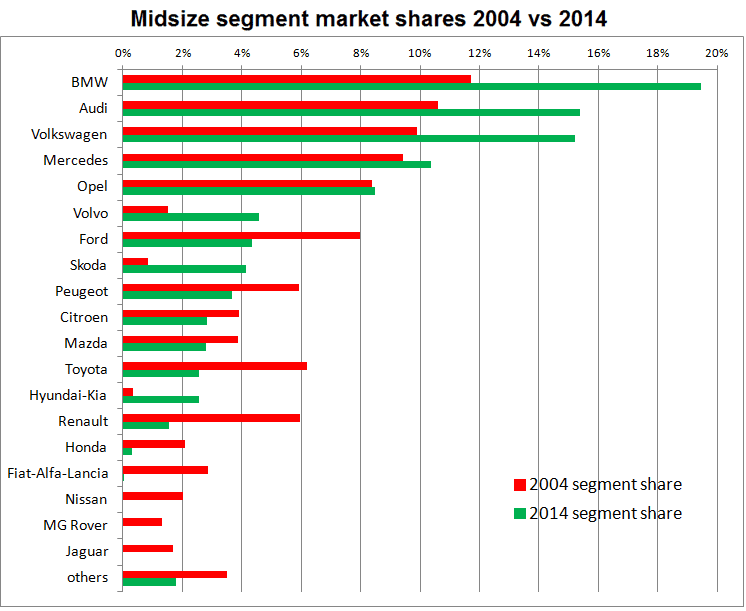

BMW is the big winner of the segment, as the 3-series increased its share of the segment from 11,7% ten years ago to 19,5% this year (including the 4-series). Audi and Volkswagen shares also grew by 5 percentage points or more with their A4, A5 and Passat (including CC), followed by Volvo thanks to the success of the S60 and V60, Skoda’s Superb and Mercedes-Benz with the C-Class. Besides VW and Skoda, the only other non-premium automaker to increase its segment share is Hyundai-Kia, although the i40 and Optima remain niche players with a combined share of 2,6%, or less than 2.500 units per month.

All other mainstream brands have either lost more than half of their volume in the segment, abandoned the segment or have disappeared from the market altogether.

In the last ten years, despite selling half as many units of the Insignia in 2013 as they did of the Vectra and Signum a decade before, Opel/Vauxhall has kept its share of the segment almost stable, mostly thanks to the UK market. But Ford has fared much worse: as the third generation Mondeo has had its life cycle extended past its expiry date, sales have plummeted to just a quarter of 2003 levels.

China is the way to make volume

The French and Japanese brands have suffered across the board, with Renault suffering the most. In 2002, the first full year of sales for the Laguna II, sales reached a record of almost a quarter of a million units, but the horrible quality of the car in the early years has killed the model’s reputation. They had so many electrical malfunctions, you’d almost think Renault had bought up old stocks of Lucas parts from the British Leyland bankruptcy auction. I worked at a Renault dealership at the time and I witnessed a brand new Laguna roll off the delivery truck with a gearbox that needed a full replacement before the car could even be delivered to the customer. As a result of its destroyed reputation, Laguna sales have dwindled 93% to a mere 18.000 sales last year.

The French and Japanese brands have suffered across the board, with Renault suffering the most. In 2002, the first full year of sales for the Laguna II, sales reached a record of almost a quarter of a million units, but the horrible quality of the car in the early years has killed the model’s reputation. They had so many electrical malfunctions, you’d almost think Renault had bought up old stocks of Lucas parts from the British Leyland bankruptcy auction. I worked at a Renault dealership at the time and I witnessed a brand new Laguna roll off the delivery truck with a gearbox that needed a full replacement before the car could even be delivered to the customer. As a result of its destroyed reputation, Laguna sales have dwindled 93% to a mere 18.000 sales last year.

Peugeot and Citroën have the advantage of their presence in the enormous Chinese market, as that means more C5’s and DS5’s (including the China-only 4-door sedan) are currently being sold in the People’s Republic than in Europe, while only 62% of 508 volume is sold at home, compared to 98% for the Laguna. Other European models sold in China are the Passat (named Magotan, the Chinese also have a model named Passat, but that’s the USA version) and CC, the Insignia (named Buick Regal), and Mondeo. All four are getting more volume out of the Chinese market than at home.

Besides China, Peugeot has another market where it reaches a significant volume of midsized sales, but not with the 508. And neither with its predecessor the 407 nor with that car’s predecessor the 406. In 2013, the French are have still sold more than 160.000 units of the 405 and the similar Peugeot Pars combined in Iran. This was a temporary dip due to PSA’s shortlived cooperation with General Motors, who prohibited the French to continue their export of parts to Iran for local production. In 2014, as GM and PSA have parted ways, sales of the 405 and Pars are back up again and on target to reach upward of 200.000 sales again. Mind you, this is a vehicle that was developed and introduced in the 1980s and has racked up a total of more than 6 million units produced in its 27-year history (and counting).

Besides China, Peugeot has another market where it reaches a significant volume of midsized sales, but not with the 508. And neither with its predecessor the 407 nor with that car’s predecessor the 406. In 2013, the French are have still sold more than 160.000 units of the 405 and the similar Peugeot Pars combined in Iran. This was a temporary dip due to PSA’s shortlived cooperation with General Motors, who prohibited the French to continue their export of parts to Iran for local production. In 2014, as GM and PSA have parted ways, sales of the 405 and Pars are back up again and on target to reach upward of 200.000 sales again. Mind you, this is a vehicle that was developed and introduced in the 1980s and has racked up a total of more than 6 million units produced in its 27-year history (and counting).

If you’re not from here, get out

At the Japanese brands, Toyota has taken the biggest hit with its Europe-only Avensis, which has lost over 100.000 units of its annual volume since its 2004 peak of 142.500 sales. Then again, the Mazda6, Subaru Legacy and Honda Accord have never even reached the 100.000 annual sales milestone. But those cars are also sold in other markets outside of the continent, giving them economies of scale. For example, 2013 worldwide volume of the Mazda6 is 236.000 compared to just 40.000 for the Avensis. This volume make a very difficult business case for the Avensis and Toyota has already hinted that the model may not be replaced when it nears the end of its life cycle. The brand has stated that it’s aiming to offer a hybrid powertrain in every model it sells in Europe by 2020, but is not planning for a hybrid version of the Avensis. Toyota did however reveal that its working on an undisclosed hybrid model in the midsized car segment, but it would make sense for this to be a worldwide model. With a model that’s not specifically tailored to European tastes, and due to a limited demand for hybrid models in the diesel-heavy midsize segment, I don’t foresee Toyota return to 100.000+ territory in Europe anytime soon.

Nissan has decided to abandon the segment in 2008 after its last Primera failed to meet its expectations by a large margin. Their strategy “If you can’t be competitive, compete somewhere else” has worked out fine for them, as the Qashqai crossover that replaced it has been a runaway success and Nissan never looked back. Honda is not replacing the Accord, and Suzuki is withdrawing the unsuccessful Kizashi as Seat has done with its Exeo, which was basically an old-gen Audi A4 with a Seat nosejob. Apparently, Europeans would rather buy a used A4 instead.

Too big for the Italians?

The Italians, known for their specialization in small cars, have also abandoned the midsized car segment, for now. The Fiat Marea and Lancia Lybra had been axed in 2005 already and there are no signs for either brand to return to the segment, while Alfa Romeo is working to replace the 159 with the Giulia, leaving the brand without a midsized car from 2013 until 2016. Sergio Marchionne has big plans for the Giulia, including exporting it to North America in order to reach a significant volume. I agree that a midsized Italian car wouldn’t be able to reach a significant volume in Europe, but I’m still a bit skeptical about the car’s chances in the heavily contested USA market by a new and relatively unknown brand.

The Italians, known for their specialization in small cars, have also abandoned the midsized car segment, for now. The Fiat Marea and Lancia Lybra had been axed in 2005 already and there are no signs for either brand to return to the segment, while Alfa Romeo is working to replace the 159 with the Giulia, leaving the brand without a midsized car from 2013 until 2016. Sergio Marchionne has big plans for the Giulia, including exporting it to North America in order to reach a significant volume. I agree that a midsized Italian car wouldn’t be able to reach a significant volume in Europe, but I’m still a bit skeptical about the car’s chances in the heavily contested USA market by a new and relatively unknown brand.

I will explore the crisis in the midsized car segment further with follow-up articles in the coming weeks.