After the Chinese government exposed a large-scale fraude with its subsidies for New Energy Vehicles, Beijing has now developed and proposed two new system to stimulate manufacturers to produce and sell EVs and PHEVs in the world’s largest car market. China surpassed the US as the largest market for electric cars in 2015 and has set a target of 3 million new-energy vehicle sales by 2025. To encourage manufacturers to step into this market, central and local governments have already spent 15 billion yuan (€ 2 billion / US$ 2.25 billion) on subsidies since 2009, but plans to phase them out after 2020. The carrot will be replaced by a stick: the first proposal features a carbon credit scheme which should be introduced in the next two years, with strict enforcement from 2018. A second proposal puts a cap on average fleet fuel consumption, with extra credits for New Energy Vehicles. To enforce this limit, this new scheme will require any automaker to sell EVs and PHEVs in China if they want to keep selling gasoline-powered cars in the country, similar to California’s system. This means foreign automakers, for whom the subsidies provided too little incentive to launch electrified cars in China until now, will have to get into the New Energy Vehicle market as well.As I’ve written earlier this year, the overly generous subsidy system of the Chinese government not only costs them a huge chunk of cash at the moment the economy is starting to cool, but also offers too big a lure for malicious parties to falsely report their production or sales of EVs, most notably for passenger buses which could fetch as much as 500.000 yuan (€ 67.000,- / US$ 75,000) each. After the government investigated a number of companies, it learned that over 1 billion yuan (€ 134,2 million / US$ 149.9 million) have been purloined in 2015 by five domestic automakers , which claimed subsidies on unsold or even unfinished electric passenger buses.

After the Chinese government exposed a large-scale fraude with its subsidies for New Energy Vehicles, Beijing has now developed and proposed two new system to stimulate manufacturers to produce and sell EVs and PHEVs in the world’s largest car market. China surpassed the US as the largest market for electric cars in 2015 and has set a target of 3 million new-energy vehicle sales by 2025. To encourage manufacturers to step into this market, central and local governments have already spent 15 billion yuan (€ 2 billion / US$ 2.25 billion) on subsidies since 2009, but plans to phase them out after 2020. The carrot will be replaced by a stick: the first proposal features a carbon credit scheme which should be introduced in the next two years, with strict enforcement from 2018. A second proposal puts a cap on average fleet fuel consumption, with extra credits for New Energy Vehicles. To enforce this limit, this new scheme will require any automaker to sell EVs and PHEVs in China if they want to keep selling gasoline-powered cars in the country, similar to California’s system. This means foreign automakers, for whom the subsidies provided too little incentive to launch electrified cars in China until now, will have to get into the New Energy Vehicle market as well.As I’ve written earlier this year, the overly generous subsidy system of the Chinese government not only costs them a huge chunk of cash at the moment the economy is starting to cool, but also offers too big a lure for malicious parties to falsely report their production or sales of EVs, most notably for passenger buses which could fetch as much as 500.000 yuan (€ 67.000,- / US$ 75,000) each. After the government investigated a number of companies, it learned that over 1 billion yuan (€ 134,2 million / US$ 149.9 million) have been purloined in 2015 by five domestic automakers , which claimed subsidies on unsold or even unfinished electric passenger buses.

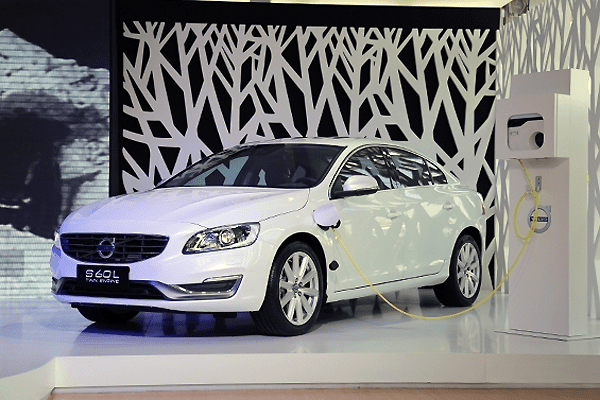

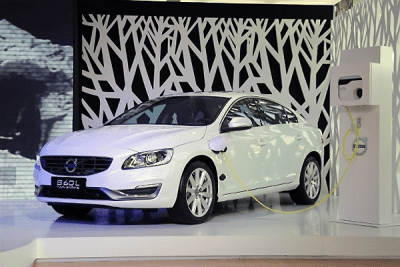

Besides encouraging fraud, another negative side effect of the generous subsidies has been that local automakers started to produce cars that raked in the most subsidies instead of the cars the market has been asking for. Last year, 330.000 New Energy Vehicles were sold in China. In the first eight months of 2016 sales more than doubled again to 245.000 units, most of them low-priced and low quality vehicles from local automakers. At the moment the only locally produced New Energy Vehicles from foreign brands are the Volvo S60L PHEV and the Nissan Leaf EV, which is sold as the Venucia e30 Morning Wind. The only imported NEVs in China are the BMW i3 (both with and without Range Extender) and i8, the Mercedes-Benz C350eL, GLE500e and S500eL, Tesla Model S and Model X, Volkswagen Golf GTE and Volvo XC90PHEV. Other automakers have announced plans to get into the market within a few years’ time, as they were waiting for the market for these vehicles to improve, but now Beijing will force them to put their money where their mouth is.

Besides encouraging fraud, another negative side effect of the generous subsidies has been that local automakers started to produce cars that raked in the most subsidies instead of the cars the market has been asking for. Last year, 330.000 New Energy Vehicles were sold in China. In the first eight months of 2016 sales more than doubled again to 245.000 units, most of them low-priced and low quality vehicles from local automakers. At the moment the only locally produced New Energy Vehicles from foreign brands are the Volvo S60L PHEV and the Nissan Leaf EV, which is sold as the Venucia e30 Morning Wind. The only imported NEVs in China are the BMW i3 (both with and without Range Extender) and i8, the Mercedes-Benz C350eL, GLE500e and S500eL, Tesla Model S and Model X, Volkswagen Golf GTE and Volvo XC90PHEV. Other automakers have announced plans to get into the market within a few years’ time, as they were waiting for the market for these vehicles to improve, but now Beijing will force them to put their money where their mouth is.

According to a draft regulation that was released last month, the carbon credit scheme would be applicable to all automakers producing more than 50.000 cars a year. In 2018, 8% of their sales in China should be fully electric, plug-in hybrid or fuel-cell cars, as regular hybrid cars like the Toyota Prius will not be counted as New Energy Vehicles. The bar would be raised to 10% in 2019 and 12% in 2020, with one NEV calculated as two to five units, depending on their mileage on one charge. This should encourage automakers to invest into making EVs and PHEVs with longer range which should make them more usable as daily drivers and convince customers suffering from range anxiety. Locally produced models and imported models will be treated alike. The credits will be calculated each calendar year and automakers who don’t hit their targets can purchase credits from their peers who have exceeded their target or face hefty penalties.

According to a draft regulation that was released last month, the carbon credit scheme would be applicable to all automakers producing more than 50.000 cars a year. In 2018, 8% of their sales in China should be fully electric, plug-in hybrid or fuel-cell cars, as regular hybrid cars like the Toyota Prius will not be counted as New Energy Vehicles. The bar would be raised to 10% in 2019 and 12% in 2020, with one NEV calculated as two to five units, depending on their mileage on one charge. This should encourage automakers to invest into making EVs and PHEVs with longer range which should make them more usable as daily drivers and convince customers suffering from range anxiety. Locally produced models and imported models will be treated alike. The credits will be calculated each calendar year and automakers who don’t hit their targets can purchase credits from their peers who have exceeded their target or face hefty penalties.

A second proposal focuses on average fleet fuel consumption: by 2020, Beijing requests that all automakers cut average fleet fuel consumption to 5 liters per 100km, down from 6,9 liters in 2015. EVs, PHEVs and fuel cell vehicles with a range of 50km or more in full electric mode would be credited with zero fuel consumption, and would be counted as five vehicles on top of that.

Again, the companies that exceed their target will earn positive carbon credits, but they won’t be able to sell them off to their underperforming peers in this program. The credits can only be carried over to the next two years. Those that don’t hit the target will be barred from producing or importing any vehicles that fall short of the average fleet fuel economy target, which is quite a strong message to automakers that Beijing is not playing around this time.

Let’s just hope that Chinese consumers are ready to buy these New Energy Vehicles, otherwise it’ll be particularly difficult to hit the target for foreign luxury brands to whom China has been a gold mine until now. Wealthy Chinese consumers had quite an appetite for big, gas guzzling sedans and SUVs which caught extraordinary margins in the former Communist state. In this program, they’ll have to offset these vehicles with EVs or PHEVs and find enough takers for these vehicles too. Strict enforcement of the programs will start in 2018, which doesn’t leave a whole lot of time for automakers to figure out how to meet them, but we’ve seen before that desperate times are a boon for creativity and China is too big and too profitable a market to run the risk of losing access to.

Let’s just hope that Chinese consumers are ready to buy these New Energy Vehicles, otherwise it’ll be particularly difficult to hit the target for foreign luxury brands to whom China has been a gold mine until now. Wealthy Chinese consumers had quite an appetite for big, gas guzzling sedans and SUVs which caught extraordinary margins in the former Communist state. In this program, they’ll have to offset these vehicles with EVs or PHEVs and find enough takers for these vehicles too. Strict enforcement of the programs will start in 2018, which doesn’t leave a whole lot of time for automakers to figure out how to meet them, but we’ve seen before that desperate times are a boon for creativity and China is too big and too profitable a market to run the risk of losing access to.

At least I’m glad to see that the Chinese government is serious about improving the air quality in especially its large cities and is keeping the environment high on its agenda, at least as far as the automotive industry is concerned. In their turn, manufacturers will benefit from these programs as it will speed up the investment in fleet electrification, which should bring economies of scale, leading to lower prices and therefore helping the acceptance of EVs all over the world. May other governments follow suit, the industry only stands to benefit.