This is a guest post from one of our enthusiast readers, Colman Murphy. If you’re interested in reaching an audience of almost 200,000 monthly viewers with your automotive related article, get in touch with us! We’re looking for guest writers and additional staff.

The acquisition of Solar City by Tesla on November 21st leaves no doubt the latter is increasingly an energy company. Question is, does that make it less of a car company? I doubt Elon Musk feels compelled to focus on just one business — he’s had his hands simultaneously in Space-X, Tesla and Solar City for a decade now — but the combined debt and portfolios of Tesla and Solar City must be a source of many a discussion if not discontent among the company’s board and its investors. Earlier this year, this website already discussed a vision of long-term strategy of Tesla, which also brought up the idea that Elon Musk is looking beyond its current form as a car manufacturer.

The acquisition of Solar City by Tesla on November 21st leaves no doubt the latter is increasingly an energy company. Question is, does that make it less of a car company? I doubt Elon Musk feels compelled to focus on just one business — he’s had his hands simultaneously in Space-X, Tesla and Solar City for a decade now — but the combined debt and portfolios of Tesla and Solar City must be a source of many a discussion if not discontent among the company’s board and its investors. Earlier this year, this website already discussed a vision of long-term strategy of Tesla, which also brought up the idea that Elon Musk is looking beyond its current form as a car manufacturer.

There are no indications that Tesla must exit the car market, at least not in the near term. There are very few other brands — automotive or otherwise — that have executed their vision as effectively as Tesla, and that brand strength alone could carry the company for many years. But the Electric Vehicle/Plug-in Electric Vehicle (PEV) landscape is getting ever so crowded; Tesla’s next vehicle, the Model 3, will impose significant pressure on its profit margins; and a Republican-controlled US government is more likely to favor low oil prices and big trucks from the major corporations over green-technology vehicles made by niche manufacturers on the West Coast. With that as backdrop, a move away from cars might well be the right move for Tesla.

Tesla has done a phenomenal job of changing how we think of electric cars.

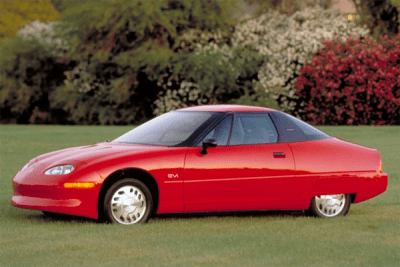

To get to where it is today required that Tesla not just build great cars, but also that the company eliminate the biases people had about electric cars from earlier models like the General Motors EV1. Those biases included:

- EVs have the performance and handling dynamics of a milk float

Tesla’s first car, the 2008 Tesla Roadster, blasted that myth to smithereens. The Roadster boasted a 0–60 mph time of 3.9 seconds — putting it in the same realm as the 2008 Lamborghini Murcielago LP460 and Ferrari F430 Scuderia — and an electronically limited top speed of 125 mph, or 200 km/h. Based off a heavily-modified Lotus Elise platform but packing an extra 700 pounds of lithium-ion batteries, the Roadster maintained much of the cornering and handling dynamics of the Lotus thanks to its low center of gravity. In a head-to-head autocross challenge conducted by Road & Track magazine, the Roadster’s lap times were within 3% of the Elise, leaving no doubts about its performance and handling dynamics.

Tesla’s first car, the 2008 Tesla Roadster, blasted that myth to smithereens. The Roadster boasted a 0–60 mph time of 3.9 seconds — putting it in the same realm as the 2008 Lamborghini Murcielago LP460 and Ferrari F430 Scuderia — and an electronically limited top speed of 125 mph, or 200 km/h. Based off a heavily-modified Lotus Elise platform but packing an extra 700 pounds of lithium-ion batteries, the Roadster maintained much of the cornering and handling dynamics of the Lotus thanks to its low center of gravity. In a head-to-head autocross challenge conducted by Road & Track magazine, the Roadster’s lap times were within 3% of the Elise, leaving no doubts about its performance and handling dynamics.

- EVs are impractical

The GM EV1 and Honda EV Plus offered a range of about 100 miles, an 80 mph top speed, limited storage space and the former also just seating for two. In short they were completely unsuited to life as a family car. The Tesla Model S was designed to compete against BMW, Porsche, Mercedes-Benz and Maserati in the luxury sedan segment. It’s a mature car with plush leather, a killer infotainment system and other amazing tech, including all the driver assist features this segment demands. It also offers the essential capability that earlier EVs lacked: range. By switching from lead-acid to LiOn Tesla has been able to squeeze almost 3 times the energy out of every pound of battery, yielding significantly greater range: close to 340 miles (570 km in the European Driving Cycle) with the current P100D. That’ll still leave you a few miles short if you hope to drive from San Francisco to LA or from Frankfurt to Milan, but once again Tesla has you covered. Instead of complaining about the lack of charging infrastructure and waiting for it to magically materialize, Tesla went ahead and built its own. As of November 2016 there are 750 Supercharger stations along major commute and travel corridors in the US and another 750 across Europe, allowing a driver to add 150 miles (240 km) of range in less than 30 minutes. Tesla has taken it one step further, placing Superchargers at high-end restaurants and hotels that attract a more affluent clientele. Tesla has transformed EV charging from a chore to a cachet activity.

The GM EV1 and Honda EV Plus offered a range of about 100 miles, an 80 mph top speed, limited storage space and the former also just seating for two. In short they were completely unsuited to life as a family car. The Tesla Model S was designed to compete against BMW, Porsche, Mercedes-Benz and Maserati in the luxury sedan segment. It’s a mature car with plush leather, a killer infotainment system and other amazing tech, including all the driver assist features this segment demands. It also offers the essential capability that earlier EVs lacked: range. By switching from lead-acid to LiOn Tesla has been able to squeeze almost 3 times the energy out of every pound of battery, yielding significantly greater range: close to 340 miles (570 km in the European Driving Cycle) with the current P100D. That’ll still leave you a few miles short if you hope to drive from San Francisco to LA or from Frankfurt to Milan, but once again Tesla has you covered. Instead of complaining about the lack of charging infrastructure and waiting for it to magically materialize, Tesla went ahead and built its own. As of November 2016 there are 750 Supercharger stations along major commute and travel corridors in the US and another 750 across Europe, allowing a driver to add 150 miles (240 km) of range in less than 30 minutes. Tesla has taken it one step further, placing Superchargers at high-end restaurants and hotels that attract a more affluent clientele. Tesla has transformed EV charging from a chore to a cachet activity.

- EVs are not cool

The GM EV1 looked conspicuously different, just to be different. The first generation Honda Insight — a hybrid, but otherwise drawn with the same pen — wasn’t much better. Both appealed to people who cared about the environment and really really really wanted you to know that. This made the cars even less appealing to the remaining 99.998% of car buyers. They served as effective testbeds of market receptiveness but didn’t provide a lot of actionable data other than “not that, thanks.” Most manufacturers walked away from pure electric vehicles after the EV1. Honda sharpened it’s focus and delivered a more practical gas-electric hybrid, the Honda Civic Hybrid, in 2001. Toyota launched the global edition of the now-ubiquitous Prius in 2000. Most major manufacturers came out with their own variants of compact hybrids over the next few years. While not as gut-wrenchingly awful as the first generation, the vast majority offered a sad compromise between cost containment and mass-market appeal. Saving the planet and riding in the HOV lane demand low-spec finishes, tinny sheetmetal and wimpy performance — being green equals sacrifices, citizens!

The GM EV1 looked conspicuously different, just to be different. The first generation Honda Insight — a hybrid, but otherwise drawn with the same pen — wasn’t much better. Both appealed to people who cared about the environment and really really really wanted you to know that. This made the cars even less appealing to the remaining 99.998% of car buyers. They served as effective testbeds of market receptiveness but didn’t provide a lot of actionable data other than “not that, thanks.” Most manufacturers walked away from pure electric vehicles after the EV1. Honda sharpened it’s focus and delivered a more practical gas-electric hybrid, the Honda Civic Hybrid, in 2001. Toyota launched the global edition of the now-ubiquitous Prius in 2000. Most major manufacturers came out with their own variants of compact hybrids over the next few years. While not as gut-wrenchingly awful as the first generation, the vast majority offered a sad compromise between cost containment and mass-market appeal. Saving the planet and riding in the HOV lane demand low-spec finishes, tinny sheetmetal and wimpy performance — being green equals sacrifices, citizens!

Tesla said screw that and went fishing in a different pond. They reached out to the affluent, tech savvy risk-takers and early adopters of Silicon Valley and Hollywood and invited them to share their vision of a new kind of car company, centered in technology. On July 19th 2006 at the Barker Hangar in Santa Monica, California, Tesla unveiled the Roadster to a select audience, inviting them to become part of the “Signature One Hundred” — the first 100 people to put down $100,000 and pre-order a Roadster. Within two weeks they had sold 127 cars, and in just a couple of years Tesla had turned EV ownership into a statement of personal refinement and exclusivity, opening the door for other luxury brands to follow.

Tesla’s success could be its downfall

Tesla’s brand may be built on exclusivity but its cachet has been democratized. Thanks to Tesla, it’s now OK to own an EV. And it’s OK to build one too. At this point every car company offers (Plug-in) hybrid variants of their top brands; and most have EV models on the street or in development. Whatever your brand of choice, from Smart to Porsche, there is or will be an EV option for you. Nissan, Toyota, Honda and Mitsubishi continue to refine their low- and mid-market lineups. The leading European manufacturers have set up dedicated lines of business to develop next-gen EV platforms that can serve a breadth of segments, from compact to luxury to SUV models. BMWs i line and Audi’s e-Tron are well out the gate. Mercedes has committed over $2B to develop it’s EQ subbrand with its Electric Vehicle Architecture (EVA) platform. And VW — still the world’s #2 car manufacturer — hopes to claw it’s way back to respectability by pouring billions into EVs and hybrids with its new Moia brand. Among the American manufacturers, Ford has consistently been in the top 5 with its plug-in and hybrid variants of mainstream brands such as the Fusion. Chevrolet has racked up significant experience and sales with the Volt, and will deepen its know-how and market share when the battery-only Bolt hits the market later in 2016.

Tesla’s brand may be built on exclusivity but its cachet has been democratized. Thanks to Tesla, it’s now OK to own an EV. And it’s OK to build one too. At this point every car company offers (Plug-in) hybrid variants of their top brands; and most have EV models on the street or in development. Whatever your brand of choice, from Smart to Porsche, there is or will be an EV option for you. Nissan, Toyota, Honda and Mitsubishi continue to refine their low- and mid-market lineups. The leading European manufacturers have set up dedicated lines of business to develop next-gen EV platforms that can serve a breadth of segments, from compact to luxury to SUV models. BMWs i line and Audi’s e-Tron are well out the gate. Mercedes has committed over $2B to develop it’s EQ subbrand with its Electric Vehicle Architecture (EVA) platform. And VW — still the world’s #2 car manufacturer — hopes to claw it’s way back to respectability by pouring billions into EVs and hybrids with its new Moia brand. Among the American manufacturers, Ford has consistently been in the top 5 with its plug-in and hybrid variants of mainstream brands such as the Fusion. Chevrolet has racked up significant experience and sales with the Volt, and will deepen its know-how and market share when the battery-only Bolt hits the market later in 2016.

China has a huge internal appetite for home-grown PEVs, surpassing both the US and EU in September for cumulative PEVs sold to date, and the upcoming EV quota in China will require manufacturers active in the world’s biggest car market to produce (and thus sell) one EV or two plug-in hybrids for every 50 conventional vehicles they will build in 2018. In the most recent report from Inside EVs there are 27 PEVs on sale in the US, with an additional 5 set to launch before the end of 2016. Two of these could have a significant impact on Tesla’s 2017–2020 plans — the 2017 Chevrolet Bolt EV, offering 238 miles (380km) of all-electric range from $37,495; and the 2017 Toyota Prius Prime, offering 25 miles (40 km) of range in pure electric mode with a $27,960 base price. Toyota has publicly stated it hopes to sell 1 million of this model over the typical 5-year lifespan; equating to 200,000 per year. In Europe, Renault has just updated the Zoe EV to give the subcompact hatchback a realistic range of 300km for a base price of € 23,900 in France and Opel/Vauxhall will get a version of the Bolt, called Ampera-e, for under € 40,000.

China has a huge internal appetite for home-grown PEVs, surpassing both the US and EU in September for cumulative PEVs sold to date, and the upcoming EV quota in China will require manufacturers active in the world’s biggest car market to produce (and thus sell) one EV or two plug-in hybrids for every 50 conventional vehicles they will build in 2018. In the most recent report from Inside EVs there are 27 PEVs on sale in the US, with an additional 5 set to launch before the end of 2016. Two of these could have a significant impact on Tesla’s 2017–2020 plans — the 2017 Chevrolet Bolt EV, offering 238 miles (380km) of all-electric range from $37,495; and the 2017 Toyota Prius Prime, offering 25 miles (40 km) of range in pure electric mode with a $27,960 base price. Toyota has publicly stated it hopes to sell 1 million of this model over the typical 5-year lifespan; equating to 200,000 per year. In Europe, Renault has just updated the Zoe EV to give the subcompact hatchback a realistic range of 300km for a base price of € 23,900 in France and Opel/Vauxhall will get a version of the Bolt, called Ampera-e, for under € 40,000.

Almost without exception, every car manufacturer looks at Tesla as the brand to beat in the EV space. And it’s not just the established car companies that are gunning for this space. Tesla has proven it’s possible to set up a new car company in the US, outside of Detroit. Correction: Tesla has proven it’s possible to set up a new transportation platform that meets the rapidly changing expectations of commuters. Whether that means autonomous vehicles, transportation as a service or just more connected, immersive in-motion environments, Tesla has already shown the world how to do it. A slew of companies have set up shop here in Silicon Valley in the last five years, driven by easy access to funding and EV know-how — including the know-how of former Tesla employees. Nio — a subsidiary/rebranding of NextEV — established its worldwide headquarters in San Jose in October. The company, which was founded by William Li — a Chinese entrepreneur who created online car sales company Bitauto — has plans to build a series of electric and autonomous cars for global markets. Down the street from NextEV is LeEco, another Chinese-backed company building electric vehicles. Lucid Motors , previously Atieva, has set up shop in Menlo Park. Chinese auto parts company Wanxiang is restarting Fisker Automotive, building its plug-in electric Karma car. Another Chinese entrepreneur, Jia Yueting, is building a mega-factory in Nevada to produce the Faraday Future to compete against Tesla. Almost all are initially aiming for the high-end of the market, with high performance EVs.

Almost without exception, every car manufacturer looks at Tesla as the brand to beat in the EV space. And it’s not just the established car companies that are gunning for this space. Tesla has proven it’s possible to set up a new car company in the US, outside of Detroit. Correction: Tesla has proven it’s possible to set up a new transportation platform that meets the rapidly changing expectations of commuters. Whether that means autonomous vehicles, transportation as a service or just more connected, immersive in-motion environments, Tesla has already shown the world how to do it. A slew of companies have set up shop here in Silicon Valley in the last five years, driven by easy access to funding and EV know-how — including the know-how of former Tesla employees. Nio — a subsidiary/rebranding of NextEV — established its worldwide headquarters in San Jose in October. The company, which was founded by William Li — a Chinese entrepreneur who created online car sales company Bitauto — has plans to build a series of electric and autonomous cars for global markets. Down the street from NextEV is LeEco, another Chinese-backed company building electric vehicles. Lucid Motors , previously Atieva, has set up shop in Menlo Park. Chinese auto parts company Wanxiang is restarting Fisker Automotive, building its plug-in electric Karma car. Another Chinese entrepreneur, Jia Yueting, is building a mega-factory in Nevada to produce the Faraday Future to compete against Tesla. Almost all are initially aiming for the high-end of the market, with high performance EVs.

As competition heats up, the Model 3 market cools down

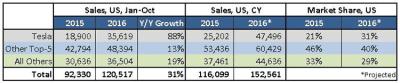

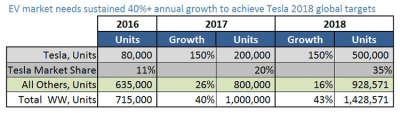

The PEV segment is growing at a phenomenal rate, up almost 31% both globally and in the US (Jan-Oct 2016 v. Jan-Oct 2015). If that rate continues, total PEV sales for the year could hit 716,000. Within that Tesla is seeing incredible growth: up 88% YTD in the US compared to last year and increased market share. Tesla expects to ship between 80,000 and 90,000 vehicles this year. The future surely looks bright for Tesla’s next offering then, the $35,000 Model 3.

Maybe not. While Tesla has indeed seen incredible growth this year, most of it came from the Model X, a premium-priced SUV. Digging into the sales figures for all 27 PEVs on the US market, we see a distinct move away from the middle market where the Model 3 will play. While Tesla grew volume by 88% with its combined two models, sales of the other four cars in the top 5 (counting both Tesla models as 1 for continuity from 2015) grew by less than 6,000 units. You could read that as good news for Tesla — it’s brand is attracting buyers in droves, so the recipe will work equally well for the more budget-minded customers. A Tesla for $35K? Who can resist? Tesla claims to already have 400,000 deposits worldwide secured for the Model 3 so they’ve got a healthy pipeline for the foreseeable future. But that still does not equate to the 500,000 annual volume they hope to hit by 2018. Again, the segment where the Model 3 will play has grown by just 6,000 units in the US in 2016. Ford and Chevy had strong growth, but only by stealing market share from Nissan and BMW. The Chevy Bolt and the Toyota Prius Prime will join this segment later this year, and BMW has improved its i3 this year, giving it a large enough range for buyers to forsake the expensive Range Extender option. So Tesla is about to enter a stagnant space with lots of competitors.

Even if the argument holds true that people will choose Tesla over other brands, there are bigger dynamics at play. The EV market is simply not growing fast enough to deliver the combined numbers that Tesla, Toyota, Chevrolet, Ford, BMW, VW, Mercedes and Nissan have in mind. Global EV growth is very robust this year at 31%, but that’s significantly lower than last year’s 55%. In order to achieve Tesla’s stated target volume of 500,000 units a year by the end of 2018, the overall worldwide EV market will have to grow at a sustained 40%+ each year, and Tesla’s market share needs to increase three-fold.

The argument that the growth will happen as people switch from regular cars to EVs is also suspect. As of November 2016, US car sales are down almost 9% from 2015, and small SUVs are down 5%. In all other segments - crossovers, large SUVs, minivans, and especially pickup trucks- sales are up.

Enough Already, What About Solar City?

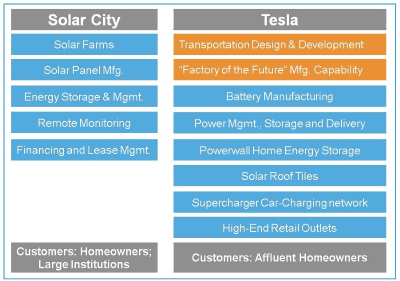

Other than saddling Tesla with enormous legacy debt — and a significant monthly burn-rate in the form of inventory, employees and infrastructure — the Solar City acquisition/bailout is actually not such a bad idea. Especially if Tesla gets out of the car business and just focuses on being an energy company. Comparing the portfolios side-by-side, there’s a lot more Solar City in Tesla than the other way round. Each of the existing Tesla assets in blue below could immediately be applied to the Solar City business. The Tesla name would give Solar City a much needed brand boost, and Tesla’s high-end retail spaces provide the perfect environment to upsell the well-heeled to the integrated Tesla vision of power generation, storage, use and management.

In this world view, the transportation design and manufacturing business i.e. Tesla Motors could be spun out into a services business, helping other transportation/tech startups navigate through the myriad challenges of creating a road-legal vehicle. I’m guessing that won’t happen, given Musk’s and Tesla’s recent history with Mercedes and Toyota. But at least one of those Chinese-American startups would be very interested in a buyout of the manufacturing and systems IP, if that opportunity arose. Tesla still wins, especially if they get to be the supplier of the power system , which truly is their unique niche anyhow.

Why would Elon Musk go for this now, when Tesla is, without question, the most recognized and vaunted EV brand on the planet? Well let me ask a reciprocal question: If Elon Musk had already reached Mars, do you think he’d keep firing rockets at it?

Disclaimer: I have no affiliation with Tesla or any other car company. All of the information shared here has been culled from publicly-available documents. I’m just passionate about cars, technology, and the crazy things that humans — including Elon Musk — like to do.