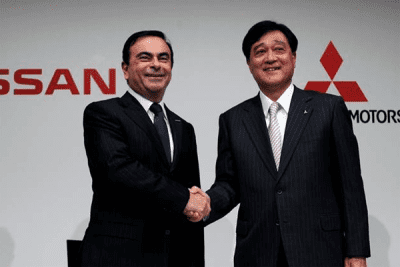

It shouldn’t really surprise anybody that Mitsubishi finally got taken over by a larger auto maker, the brand was simply too small and too irrelevant in the world’s most important markets to survive on its own. But the way Nissan played its cards was a stroke of genius, whether intentional from the get-go or just improvising on the opportunity at hand. Mitsubishi has supplied its bigger rival with Japanese market minicars (“Kei” cars, as described in my article on the Japanese auto culture) since 2011 and when Nissan was testing the pre-production next generation cars they found some irregularities with the reported fuel economy figures. This led to a public scandal in which Mitsubishi had to admit some of its engineers had been using a trick with tire pressures for the past 25 years to overstate fuel economy of its Japanese market cars (and perhaps some cars sold outside of Japan), causing Mitsubishi’s share prices on the stock market to almost halve. Nissan then scooped up 34% of these shares at the heavily discounted price for a controlling stake to become Mitsubishi’s largest single shareholder. It’ll take a few months to complete the takeover, and there are still quite a few issues to be handled before the deal will be finalized, but looking ahead: what will Nissan do with Mitsubishi?

It shouldn’t really surprise anybody that Mitsubishi finally got taken over by a larger auto maker, the brand was simply too small and too irrelevant in the world’s most important markets to survive on its own. But the way Nissan played its cards was a stroke of genius, whether intentional from the get-go or just improvising on the opportunity at hand. Mitsubishi has supplied its bigger rival with Japanese market minicars (“Kei” cars, as described in my article on the Japanese auto culture) since 2011 and when Nissan was testing the pre-production next generation cars they found some irregularities with the reported fuel economy figures. This led to a public scandal in which Mitsubishi had to admit some of its engineers had been using a trick with tire pressures for the past 25 years to overstate fuel economy of its Japanese market cars (and perhaps some cars sold outside of Japan), causing Mitsubishi’s share prices on the stock market to almost halve. Nissan then scooped up 34% of these shares at the heavily discounted price for a controlling stake to become Mitsubishi’s largest single shareholder. It’ll take a few months to complete the takeover, and there are still quite a few issues to be handled before the deal will be finalized, but looking ahead: what will Nissan do with Mitsubishi?

For starters, there are currently no plans to phase out the brand entirely, as Nissan CEO Carlos Ghosn has already pointed out. The Mitsubishi brand may not have a lot of relevance in the US, Europe and especially China, but it does still have a lot of equity in important markets in South East Asia, exactly the markets where Nissan is still struggling, like Indonesia (#5 brand with 112.000 sales in 2015 vs. Nissan’s 25.000, plus 29.000 Datsun), Thailand (#4 brand with 60.000 sales in 2015 vs. Nissan’s 51.000), the Philippines (#2 brand with 54.000 sales in 2015 vs. Nissan’s 11.000) and even in Australia (#5 brand with 72.000 sales in 2015 vs. Nissan’s 66.000), mostly thanks to its Triton pick-up truck, the Pajero Sport SUV version of that truck, and the Mirage minicar. But what about those major markets? Mitsubishi has less than one percent market share in Europe (Nissan almost 4%), half a percent of market share in the US (Nissan over 8%) and has sold just 9.000 units in the first four months of 2016 in China, the world’s largest car market at over 7 million units in those same four months (Nissan: 257.000 sales).

For starters, there are currently no plans to phase out the brand entirely, as Nissan CEO Carlos Ghosn has already pointed out. The Mitsubishi brand may not have a lot of relevance in the US, Europe and especially China, but it does still have a lot of equity in important markets in South East Asia, exactly the markets where Nissan is still struggling, like Indonesia (#5 brand with 112.000 sales in 2015 vs. Nissan’s 25.000, plus 29.000 Datsun), Thailand (#4 brand with 60.000 sales in 2015 vs. Nissan’s 51.000), the Philippines (#2 brand with 54.000 sales in 2015 vs. Nissan’s 11.000) and even in Australia (#5 brand with 72.000 sales in 2015 vs. Nissan’s 66.000), mostly thanks to its Triton pick-up truck, the Pajero Sport SUV version of that truck, and the Mirage minicar. But what about those major markets? Mitsubishi has less than one percent market share in Europe (Nissan almost 4%), half a percent of market share in the US (Nissan over 8%) and has sold just 9.000 units in the first four months of 2016 in China, the world’s largest car market at over 7 million units in those same four months (Nissan: 257.000 sales).

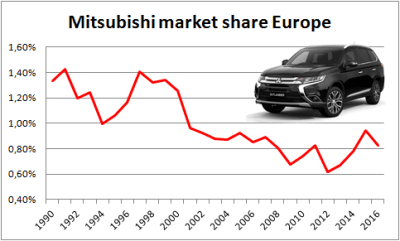

Europe

In Europe, Mitsubishi isn’t even doing too bad. It held almost a percent of market share last year, selling almost 133.000 units, which is an impressive rebound from its low of just 77.000 cars three years earlier, but still far away from the 205.000 units it sold at its peak in 1999. And this winning streak appears to have come to an end, with 2016 sales down 5,9% in the first four months. Such fluctuations are often visible at brands with a very thin line-up, as they’re heavily dependent on the freshness of the few models they have. Just 3 current Mitsubishi models in Europe have an annual volume of over 6.000 sales and those three account for more than 91% of the brand’s European volume: the low-margin Mirage minicar, the Outlander SUV (boosted by the PHEV version which is heavily subsidized in most European countries) and the aging ASX crossover. Mitsubishi has no entry in the continent’s largest segment, that of subcompact cars, and with the aging Lancer it has an uncompetitive entry in the second-largest segment, that of compact cars. The brand has said it will not develop cars for those segments as it will prioritize its resources on launching more SUVs and crossovers and focus on the growing South East Asian markets instead. That means the growth potential for the brand will remain limited, unless Nissan decides to supply it with rebadged Nissan cars, but such a strategy has barely ever done wonders for a struggling brand’s image or volumes. As I’ve said before, rebadged models have a very small chance of actually becoming successful, because they’re either not adapted to the local market or the design doesn’t really fit within the rest of the brand and customers will prefer the original anyways.

In Europe, Mitsubishi isn’t even doing too bad. It held almost a percent of market share last year, selling almost 133.000 units, which is an impressive rebound from its low of just 77.000 cars three years earlier, but still far away from the 205.000 units it sold at its peak in 1999. And this winning streak appears to have come to an end, with 2016 sales down 5,9% in the first four months. Such fluctuations are often visible at brands with a very thin line-up, as they’re heavily dependent on the freshness of the few models they have. Just 3 current Mitsubishi models in Europe have an annual volume of over 6.000 sales and those three account for more than 91% of the brand’s European volume: the low-margin Mirage minicar, the Outlander SUV (boosted by the PHEV version which is heavily subsidized in most European countries) and the aging ASX crossover. Mitsubishi has no entry in the continent’s largest segment, that of subcompact cars, and with the aging Lancer it has an uncompetitive entry in the second-largest segment, that of compact cars. The brand has said it will not develop cars for those segments as it will prioritize its resources on launching more SUVs and crossovers and focus on the growing South East Asian markets instead. That means the growth potential for the brand will remain limited, unless Nissan decides to supply it with rebadged Nissan cars, but such a strategy has barely ever done wonders for a struggling brand’s image or volumes. As I’ve said before, rebadged models have a very small chance of actually becoming successful, because they’re either not adapted to the local market or the design doesn’t really fit within the rest of the brand and customers will prefer the original anyways.

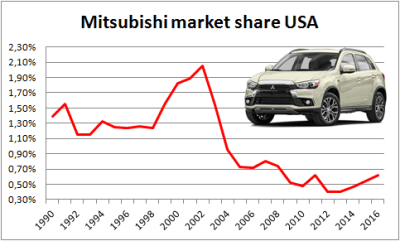

United States

Mitsubishi’s US operations made the tiniest operating profit of just $ 55 million last fiscal year, up from an even thinner $ 4 million a year earlier, after six years of continued losses. From its peak of almost 350.000 US sales in 2002, the brand has come a long way down to just 54.000 sales in 2009 before slowly and slightly rebounding to still less than 100.000 sales last year from a four-vehicle line-up. In order to make Mitsubishi a relevant player in the US again, that line-up is in desperate need of an overhaul and some fresh product. And since the development of new products takes years of time and a millions of dollars, both of which Mitsubishi doesn’t have at the moment, that would likely translate into Mitsubishi versions of Nissan cars. But besides the objections I’ve already mentioned above against this strategy, there’s another issue with it in the States: Nissan’s US and Mexican factories are already working three shifts to produce enough cars to fill the current demand for Nissan-badged cars and trucks, and it had to shift some production of the hot-selling Rogue crossover to plants in South-Korea and Japan, so Nissan doesn’t have any North American production capacity for additional Mitsubishi models. Unfortunately, Mitsubishi has just sold off the only production facility it operated in the United States, so the timing is a bit late as well.

Mitsubishi’s US operations made the tiniest operating profit of just $ 55 million last fiscal year, up from an even thinner $ 4 million a year earlier, after six years of continued losses. From its peak of almost 350.000 US sales in 2002, the brand has come a long way down to just 54.000 sales in 2009 before slowly and slightly rebounding to still less than 100.000 sales last year from a four-vehicle line-up. In order to make Mitsubishi a relevant player in the US again, that line-up is in desperate need of an overhaul and some fresh product. And since the development of new products takes years of time and a millions of dollars, both of which Mitsubishi doesn’t have at the moment, that would likely translate into Mitsubishi versions of Nissan cars. But besides the objections I’ve already mentioned above against this strategy, there’s another issue with it in the States: Nissan’s US and Mexican factories are already working three shifts to produce enough cars to fill the current demand for Nissan-badged cars and trucks, and it had to shift some production of the hot-selling Rogue crossover to plants in South-Korea and Japan, so Nissan doesn’t have any North American production capacity for additional Mitsubishi models. Unfortunately, Mitsubishi has just sold off the only production facility it operated in the United States, so the timing is a bit late as well.

According to Ghosn, “The potential for cooperation in the Americas in general, not only North America but South America, has absolutely not been touched. […] Purchasing, common platform, joint technology, Southeast Asia. These are obvious things.” So where does that leave Mitsubishi? If the US market continues to stay ignored under new ownership, the brand will quickly sink into further irrelevance, making the decision to exit North America just that much easier.

China

Despite being one of the first foreign auto makers to enter China in the 1980s, and despite priding itself at being an SUV specialist, a segment that’s currently smoking hot in China, Mitsubishi is utterly irrelevant in China with a market share of just 0,13% in the first four months of 2016, and just one of its six local models selling more than 1.000 units so far this year.

Despite being one of the first foreign auto makers to enter China in the 1980s, and despite priding itself at being an SUV specialist, a segment that’s currently smoking hot in China, Mitsubishi is utterly irrelevant in China with a market share of just 0,13% in the first four months of 2016, and just one of its six local models selling more than 1.000 units so far this year.

Besides that, there’s another issue in China that will need to be dealt with before the takeover can be completed. The Chinese government has a policy that no foreign auto maker is allowed to have more than two Joint Ventures with local Chinese partners, and that includes affiliate brands, which Nissan and Mitsubishi will be after the former has completed its acquisition of the controlling 34% stake. Nissan and its other partner Renault already have a Joint Venture with Dongfeng while Mitsubishi, small as it is, has two partnerships: one with GAC for the production of the ASX crossover and Pajero Sport SUV, established in 2012, and one with Fujian Auto and China Motor Corp. of Taiwan (also partially owned by Mitsubishi) in the form of Soueast Motor, which it joined in 2006 and which produces Mitsubishi’s struggling sedans and a line-up of Mitsubishi-based cars and crossovers under its own brand. One of these two partnerships will have to be cut this year if Nissan wants to complete its takeover.

This means Mitsubishi will lose either 90% of its already paltry sales volume in China (if the GAC JV is terminated) or a stake in a local auto maker that is on track to sell over 100.000 Mitsubishi-based vehicles for the first time this year (Soueast). Neither of these options seems like a very desirable solution, but the easy way out would be to cut its ties with GAC and quit production of Mitsubishi brand vehicles in China altogether, while continuing to hold a 25% stake in Soueast and supply them with engines and other technology.

Is there a future for Mitsubishi?

Despite the rather bleak outlook pictured above, I don’t think the Mitsubishi brand will be phased out altogether. It still has a strong presence in the fast growing South East Asian markets where Nissan is particularly weak, and it also still has a solid reputation as a maker of SUVs and pick-up trucks. Moreover, with Carlos Ghosn at the helm, the brand could even face a surprisingly quick turnaround in a similar fashion he has done when taking over control at Renault and later at Nissan. Behind the scenes, Ghosn is a master in cutting overlapping costs and will make sure both parties will benefit from synergies in common vehicle platforms and shared electric-car technologies as well as combined purchasing power as a result of forming the fourth largest auto company in the world.

Despite the rather bleak outlook pictured above, I don’t think the Mitsubishi brand will be phased out altogether. It still has a strong presence in the fast growing South East Asian markets where Nissan is particularly weak, and it also still has a solid reputation as a maker of SUVs and pick-up trucks. Moreover, with Carlos Ghosn at the helm, the brand could even face a surprisingly quick turnaround in a similar fashion he has done when taking over control at Renault and later at Nissan. Behind the scenes, Ghosn is a master in cutting overlapping costs and will make sure both parties will benefit from synergies in common vehicle platforms and shared electric-car technologies as well as combined purchasing power as a result of forming the fourth largest auto company in the world.

Ghosn is known for acting fast and ruthless to turn a struggling company around and for setting seemingly impossible goals which are subsequently reached ahead of time. Mitsubishi isn’t even in as bad a financial situation as Renault and Nissan were when he turned those companies around, as the Japanese company has been profitable for the last 7 years and has about 450 billion Yen (over US$ 4 billion) in net cash. However, it could burn through that cash quickly in the aftermath of the Japanese fuel economy scandal. Sales of the embattled minicars in Japan fell 45% in April and the tainted image will hurt sales of its other vehicles as well. Lost volumes, huge fines for misleading regulators and compensation to its customers and those of Mitsubishi-made Nissan vehicles could cost the company as much as 376 billion yen (US$3.4 billion), according to an analyst at Goldman Sachs.

Another analyst at Advanced Research Japan even envisions the possibility that Mitsubishi will have to quit the Japanese market altogether and focus exclusively on its profitable markets in South East Asia, where it currently sells twice as many vehicles as in its home market. However, I think that may be taking a bit too far, as Nissan will still want to share the development of the important Kei minicars with another brand and although the Japanese culture is very sensitive to corporate scandals, they also tend to be rather forgiving if the company takes responsibility, apologizes sincerely and fixes the problems quickly. That will likely mean that those responsible for the irregularities will have to face public shaming and job losses, after which Ghosn will quickly take control and start rebuilding the brand. What he’ll do with the struggling brand in Europe, the US and China remains to be seen. He’s not afraid to take difficult decisions and may ruthlessly cut the brand if he doesn’t see the potential, but he could also embrace the challenge and aim to turn Mitsubishi into a relevant player within a few years time.

Another analyst at Advanced Research Japan even envisions the possibility that Mitsubishi will have to quit the Japanese market altogether and focus exclusively on its profitable markets in South East Asia, where it currently sells twice as many vehicles as in its home market. However, I think that may be taking a bit too far, as Nissan will still want to share the development of the important Kei minicars with another brand and although the Japanese culture is very sensitive to corporate scandals, they also tend to be rather forgiving if the company takes responsibility, apologizes sincerely and fixes the problems quickly. That will likely mean that those responsible for the irregularities will have to face public shaming and job losses, after which Ghosn will quickly take control and start rebuilding the brand. What he’ll do with the struggling brand in Europe, the US and China remains to be seen. He’s not afraid to take difficult decisions and may ruthlessly cut the brand if he doesn’t see the potential, but he could also embrace the challenge and aim to turn Mitsubishi into a relevant player within a few years time.