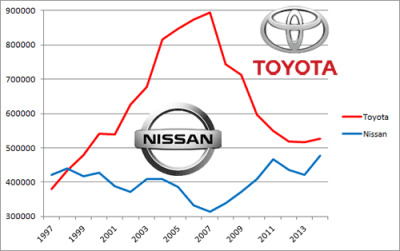

In the late 1990’s, Nissan was Europe’s best selling Asian car brand thanks to the Micra, Almera and Primera, which were the epitome of Japanese cars in that period: not very exciting, but extremely reliable. But in the early 2000’s, they tried to bring more frivolous design into their cars with the 2002 Micra K12 and 2002 Primera P12, and as a result, the once faithful customers looking for anonymous transportation stayed away. At the same time, the newly formed alliance with  Renault caused the Japanese engineers to lose their focus on bulletproof reliability, and

Renault caused the Japanese engineers to lose their focus on bulletproof reliability, and  Nissan’s sales dropped from almost 440.000 units in 1998 to just over 300.000 in 2007. Contrastingly, Toyota was growing fast, and it has held the title of biggest Asian brand in Europe since 2000, even more than doubling Nissan’s sales between 2004 and 2008.

Nissan’s sales dropped from almost 440.000 units in 1998 to just over 300.000 in 2007. Contrastingly, Toyota was growing fast, and it has held the title of biggest Asian brand in Europe since 2000, even more than doubling Nissan’s sales between 2004 and 2008.

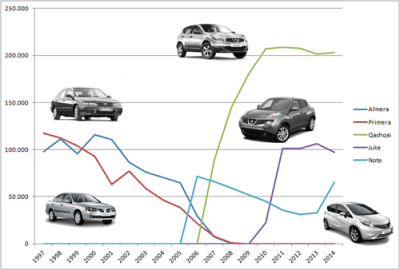

As Nissan realized that they could no longer be competitive in the regular compact hatchback and midsized sedan and station wagon segments with the Almera and Primera, they made a very risky but brave decision: abandon Europe’s second and third largest segments with combined annual volumes of 4.3 million units in 2006 (5.9 million including premium brands) in favor of relatively small, but fast-growing niche segments.

First came the Note small MPV in 2006, followed by the Qashqai midsized crossover a year later and the Juke small crossover in 2010. The philosophy behind this strategy was clever: to (re)build brand reputation, it’s better to be a trendsetter in the top-3 of a small niche segment than to be an also-ran in the bottom top-20 of a much bigger part of the market. A strategy Toyota still takes advantage of when it stalled development of diesel engines in favor of investment in hybrid technology.

As a result, Nissan sales in Europe have rebounded to record levels, closing in on the 500.000 mark in 2014, and perhaps more importantly, closing in on Toyota as the best selling Asian brand, with less than 50.000 units between the two brands in 2014. The brand has set a 2016 goal of 5% European market share (up from 3,69% in 2014) and simultaneously passing Toyota. However, as other brands have joined the party in the formerly niche segments, Nissan has lost some of its advantage of being one of the first-movers. The brand has foreseen its growth may stall and that in order to take the final step towards achieving its goal, a return to the large “mainstream” segments may be necessary.

As a result, Nissan sales in Europe have rebounded to record levels, closing in on the 500.000 mark in 2014, and perhaps more importantly, closing in on Toyota as the best selling Asian brand, with less than 50.000 units between the two brands in 2014. The brand has set a 2016 goal of 5% European market share (up from 3,69% in 2014) and simultaneously passing Toyota. However, as other brands have joined the party in the formerly niche segments, Nissan has lost some of its advantage of being one of the first-movers. The brand has foreseen its growth may stall and that in order to take the final step towards achieving its goal, a return to the large “mainstream” segments may be necessary.

However, if Nissan is serious about its ambitions of becoming the best selling Asian car brand in Europe, it should come up with something better than a half-assed attempt at a compact hatchback. Besides a roomy interior, the Pulsar has no Unique Selling Points and adds no value to the crowded and competitive segment. At a projected 64.000 annual sales, Nissan expects it to sell at half the volume of the Toyota Auris, which is also available as a station wagon, a very popular body style in Europe, and with a hybrid powertrain, which is that model’s USP. And currently, the Pulsar’s monthly sales are only half of Nissan’s expectations.

However, if Nissan is serious about its ambitions of becoming the best selling Asian car brand in Europe, it should come up with something better than a half-assed attempt at a compact hatchback. Besides a roomy interior, the Pulsar has no Unique Selling Points and adds no value to the crowded and competitive segment. At a projected 64.000 annual sales, Nissan expects it to sell at half the volume of the Toyota Auris, which is also available as a station wagon, a very popular body style in Europe, and with a hybrid powertrain, which is that model’s USP. And currently, the Pulsar’s monthly sales are only half of Nissan’s expectations.

But I think Nissan can make the biggest leap forward by replacing the Micra subcompact hatchback with a model that’s specifically designed for this continent and tailored to the tastes of European buyers. The Micra nameplate still carries some “heritage” in Europe, especially from the Micra K11 from 1992 to 2003, which was a very reliable and  no-nonsense subcompact that became the first-ever Japanese

no-nonsense subcompact that became the first-ever Japanese  car to win the European Car of the Year award in 1993 and was the best selling Asian model in Europe during most of that period, with sales regularly topping 150.000 annual units. The latter title was quickly taken over by the Toyota Yaris, after that model’s introduction in 1999. The Yaris was designed and built in Europe, with tastes of the European consumer in mind and became European Car of the Year in 2000.

car to win the European Car of the Year award in 1993 and was the best selling Asian model in Europe during most of that period, with sales regularly topping 150.000 annual units. The latter title was quickly taken over by the Toyota Yaris, after that model’s introduction in 1999. The Yaris was designed and built in Europe, with tastes of the European consumer in mind and became European Car of the Year in 2000.

The current Micra K13 is built in Indonesia for the European market, but its design is just too “Asian” for the model to return to the sales levels of its predecessor. Besides that, it’s dimensions make the Micra one of the smallest subcompact cars in the segment. Despite its excellent fuel efficiency and modern engine technology, the Micra’s sales still lag behind those of the Yaris by more than 100.000 units.

If Nissan wants to crack the European market, the next generation Micra should grow to a similar size as its platform-sibling Renault Clio and most importantly: it should be designed in Europe for the European market and preferably even produced in Europe. If Toyota can do it with the Yaris and Hyundai can do it with the i20, then Nissan should be able to do it as well with the new Micra. Especially considering the economies of scale they get from using the Renault Clio platform. With the Micra, Nissan a very strong nameplate that many potential customers still remember. If the product becomes competitive again, I’m sure it can easily become a top-10 player in the subcompact segment again. And that would give the brand enough additional sales to leapfrog Toyota as the continent’s best selling Asian manufacturer.

If Nissan wants to crack the European market, the next generation Micra should grow to a similar size as its platform-sibling Renault Clio and most importantly: it should be designed in Europe for the European market and preferably even produced in Europe. If Toyota can do it with the Yaris and Hyundai can do it with the i20, then Nissan should be able to do it as well with the new Micra. Especially considering the economies of scale they get from using the Renault Clio platform. With the Micra, Nissan a very strong nameplate that many potential customers still remember. If the product becomes competitive again, I’m sure it can easily become a top-10 player in the subcompact segment again. And that would give the brand enough additional sales to leapfrog Toyota as the continent’s best selling Asian manufacturer.