Geely and its competition

Geely competes in China’s “mass” or “mid-tier”; market, meaning the company is mostly competing for car buyers that are part of China’s enormous middle class. Geely’s main competitors are Chinese companies that manufacture their cars in China, and primarily sell their cars in China.

While the Geely brand is positioned to appeal to buyers that are looking for both affordability and quality; other brands or subsidiaries owned by Geely compete in different market segments. Geely’s subsidiary Volvo competes in the luxury car segment, and Lynk & Co. (a recently launched brand by Geely-Volvo) is positioned between the mass market and the luxury market.

Although Geely competes mostly against Chinese brands, a relatively small number of current models compete against international brands such as Chevrolet, Kia, Hyundai, Honda, and others. This convergence or merging of competition between Chinese brands and international/global brands is due to two related factors; Chinese brands are increasingly seeking to move up-market to compete with international brands, and international brands, aware of the sheer size of China’s mid-tier/mass market, see opportunity to compete down-market as well.

Geely is competitive as a brand

Geely is competitive at the brand-level. Geely ranked 3rd overall in the Chinese car market in 2017, behind Volkswagen and Honda, but ahead of other major global and domestic brands such as Buick, Toyota, Nissan, Changan, and Baojun. Considering Chinese brands alone, of the 48 brands ranked, Geely ranks highest, with an estimated 1.25 million cars sold during 2017. Considering domestic manufacturers, its closest competitor was Changan Auto, which ranked 7th overall, with 1.05 million cars sold. In summary, Geely’s cars are selling well against its competition.

Model-level analysis: approach and methodology

In terms of consumer preferences, Chinese buyers are favoring SUVs and crossovers, and to a lesser extent, sedans. To get a better understanding of Geely’s current and future competitiveness in specific market segments, sales data for recently launched (i.e. 2016-2017) Geely car models were compared to similarly priced models from competing brands.

Three types of indicators were constructed to better understand competitiveness at the model-level:

- Sales volume (number of cars sold) during the first six months after a model launch,

- Sales volume during the first twelve months after a model launch, and

- Sales volume during the most recent period; meaning the most recent six* months for which data are available.

* Note: Car models that were launched during late 2017 have less than six months of available data. For these situations, depending on data availability, 3-5 months are used to represent the “most recent period”.

SUV’s launched during 2016

Geely launched its Boyue SUV in late March of 2016. Depending on options, the Boyue sells for about 132,000 yuan (USD $20,900).

Geely launched its Boyue SUV in late March of 2016. Depending on options, the Boyue sells for about 132,000 yuan (USD $20,900).

Also in 2016, similarly priced competing SUV models were launched by Roewe, Haval and Chery, which are shown from left to right in the photos below. Considering the Boyue’s three competitors; the Haval H7 is the most expensive, at approximately 160,000 yuan (USD $25,400). The Roewe RX5 sells for roughly 143,000 yuan (USD $22,700), while Chery’s Tiggo 7 is priced at about 126,000 yuan (USD $20,000).

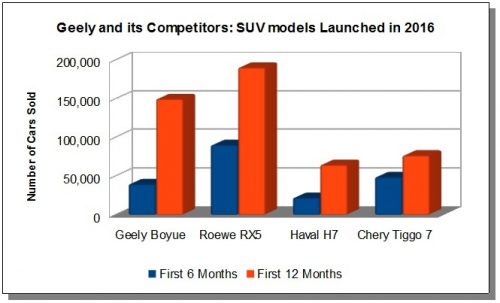

Cumulative sales (number of cars sold) for all four SUV’s are graphed and compared below. During the first six and twelve months after launch; the Roewe RX5 outsold the three competing SUVs, including Geely’s Boyue model.

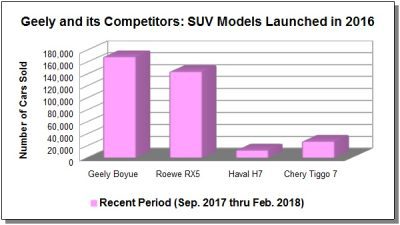

However, during the most recent period (Sep. 2017–Feb. 2018), as seen in the graph further below, the Geely Boyue overtakes the Roewe RX5. Both Haval’s H7 and Chery’s Tiggo 7 are having considerably less success during the recent period.

In summary, Geely’s Boyue SUV is competitive against similarly priced SUVs launched during 2016. Although the Boyue gets off to a somewhat sluggish start during the first six months after launch, as of more recently (Sep. 2017 – Feb. 2018); Geely’s SUV leads its competition as seen in the graph above.

Geely launched a second SUV in August of 2016; the Vision X6. Depending on options, the X6 sells for approximately 119,000 yuan, (USD $18,300).

Geely launched a second SUV in August of 2016; the Vision X6. Depending on options, the X6 sells for approximately 119,000 yuan, (USD $18,300).

Similarly priced competing SUVs were launched in 2016 by Lifan, SWM, and Hanteng, as seen below. The Hanteng X7 sells for about 114,000 yuan (USD $18,100). The SUVs from SWM (X7) and Lifan (Maiwei) sell for a bit less, at about 100,000 yuan (USD $17,400) and 94,000 yuan (USD $14,900) respectively.

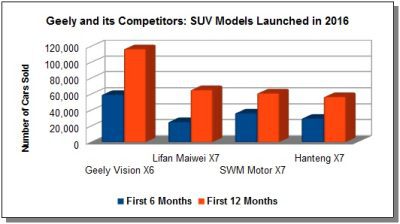

Sales performance for these four SUV models is depicted in the graphs below. Geely’s Vision X6 is clearly outselling the competing SUV models from Lifan, SWM, and Hanteng. Geely sold almost as many Vision X6’s during the first 6 months after launch as its competitors did over a 12 month period.

Sales performance for these four SUV models is depicted in the graphs below. Geely’s Vision X6 is clearly outselling the competing SUV models from Lifan, SWM, and Hanteng. Geely sold almost as many Vision X6’s during the first 6 months after launch as its competitors did over a 12 month period.

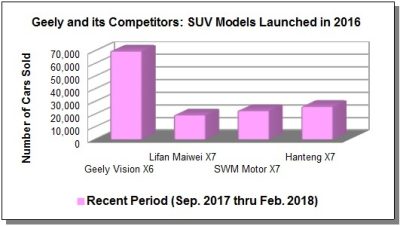

During the most recent period for which data are available (Sep. 2017 thru Feb. 2018), Geely’s sales outperformed its competitors by more than a 2 to 1 ratio, as seen in the graph below.

Crossovers launched during 2016

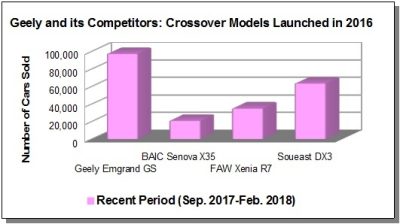

Geely’s Crossover models are also selling well. Its Emgrand GS Crossover was launched in early May of 2016. The Emgrand GS sells for about 93,000 yuan (USD $14,700).

Geely’s Crossover models are also selling well. Its Emgrand GS Crossover was launched in early May of 2016. The Emgrand GS sells for about 93,000 yuan (USD $14,700).

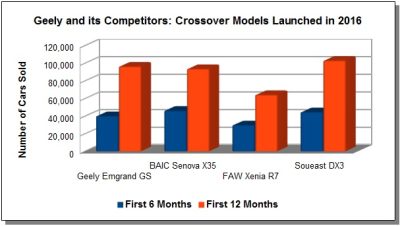

Similarly priced competing Crossovers were launched by BAIC, FAW, and Soueast during 2016; as seen further below. The Soueast DX3 is closest to Geely’s Emgrand GS in price, at 86,000 yuan (USD $13,600). The FAW Xenia R7 sells for about 82,000 yuan (USD $13,000), while the BAIC Senova X35 is priced considerably lower, at 77,300 yuan (USD $12,200).

The sales performance for all four Crossovers is shown here.

Focusing on the first 12 months after launch, Soueast’s DX3 leads the pack, nudging out Geely’s Emgrand GS and BAIC’s Senova X35. The FAW Xenia R7 trailed behind its competitors, with relatively fewer sales.

Focusing on the first 12 months after launch, Soueast’s DX3 leads the pack, nudging out Geely’s Emgrand GS and BAIC’s Senova X35. The FAW Xenia R7 trailed behind its competitors, with relatively fewer sales.

The sales data for the most recent period (Sep. 2017 – Feb. 2018) tells a noticeably different story. As seen in the graph below; sales of the Geely Emgrand GS overtake the other three models by a significant margin. In summary, Geely’s Emgrand GS Crossover competes well against comparably priced models from other Chinese manufacturers, particularly in the most recent period.

Sedans launched during 2016

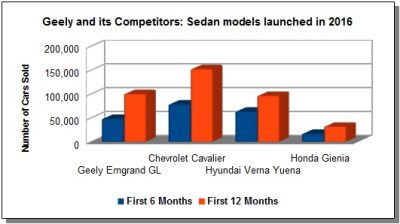

Geely’s sedan models constitute a significant portion of the company’s sales. The Geely Emgrand GL, a compact sedan launched in September of 2016, has sold relatively well against similarly priced sedans from other manufacturers, and this includes international brands to some extent. The Emgrand GL retails for about 96,000 yuan or USD $15,200.

Geely’s sedan models constitute a significant portion of the company’s sales. The Geely Emgrand GL, a compact sedan launched in September of 2016, has sold relatively well against similarly priced sedans from other manufacturers, and this includes international brands to some extent. The Emgrand GL retails for about 96,000 yuan or USD $15,200.

Similarly priced competing sedans were launched in 2016 by Chevrolet (Cavalier), Hyundai (Verna Yuena), and Honda (Gienia). The Cavalier sells for about 95,000 yuan (USD $15,100), nearly matching the price of Geely’s Emgrand GL. The sedan from Honda sells for a bit more, at about 109,000 yuan (USD $17,300). Hyundai’s sedan is the lowest priced of all four cars compared, at roughly 89,000 yuan (USD $14,100).

The Chevrolet Cavalier has far outsold the competing models from Geely, Honda and Hyundai, as seen in the graphs below.

Although Geely’s Emgrand GL got off to a slow start during the first 6 months after launch (see top- most graph above), during the most recent period, Geely’s GL outsold competing models from Hyundai and Honda.

Small Crossover Hatchbacks launched during 2017

In September of 2017, Geely launched its Vision X3, a small crossover hatchback, which is shown in the picture below. Depending on options, the X3 sells for approximately 70,000 yuan (USD $11,100).

In September of 2017, Geely launched its Vision X3, a small crossover hatchback, which is shown in the picture below. Depending on options, the X3 sells for approximately 70,000 yuan (USD $11,100).

Also during the second half of 2017, Huansu, Kia, and Zotye launched their own small crossover hatchbacks, with prices similar to that of Geely’s Vision X3. These models are shown below. The Huansu S5 sells for about 74,800 yuan (USD $11,900), while the price for the Kia KX Cross is about 80,400 yuan (USD $12,700). The Zotye T300 is priced similarly to Geely’s Vision X3 at 70,000 yuan (USD $11,100).

Sales volume data for the most recent period (Sep. 2017 thru Feb. 2018) are shown below. Geely’s Vision X3 is out-selling competitor models from Huansu, Kia, and Zotye. Kia’s KX Cross and Zotye’s T300 are also selling relatively well, while Huansu’s S5 has been less competitive.

Not included in the analysis above, is the SUV/Crossover from Baojun, known as the Baojun 510. The 510 is by far one of the most successful SUV/Crossover’s sold in China today, and sells for about 65,800 yuan (USD $10,400). In January 2018 alone, over 58,000 Baojun 510’s were sold. During the recent period (Sep. 2017 – Feb. 2018) a remarkable 288,061 Baojun 510’s have been sold. It was decided not to include the Baojun 510 in the comparisons above, largely because of its phenomenal success, it really is in a “category all its own”. Including it within the graph above would also have presented a visual display problem (y axis scale related problem), because it would have

Not included in the analysis above, is the SUV/Crossover from Baojun, known as the Baojun 510. The 510 is by far one of the most successful SUV/Crossover’s sold in China today, and sells for about 65,800 yuan (USD $10,400). In January 2018 alone, over 58,000 Baojun 510’s were sold. During the recent period (Sep. 2017 – Feb. 2018) a remarkable 288,061 Baojun 510’s have been sold. It was decided not to include the Baojun 510 in the comparisons above, largely because of its phenomenal success, it really is in a “category all its own”. Including it within the graph above would also have presented a visual display problem (y axis scale related problem), because it would have  miniaturized and “flattened out” the vertical bars associated with the other four models depicted in the graph, making it difficult to visualize meaningful differences amongst the four. Suffice it to say that the Baojun 510 is dominating the market segment within which it competes, and is far outselling the competing models from Geely, Huansu, Kia, and Zotye shown above.

miniaturized and “flattened out” the vertical bars associated with the other four models depicted in the graph, making it difficult to visualize meaningful differences amongst the four. Suffice it to say that the Baojun 510 is dominating the market segment within which it competes, and is far outselling the competing models from Geely, Huansu, Kia, and Zotye shown above.

In November of 2017, Geely launched another small crossover hatchback known as the Vision S1, seen here. Depending on options, the S1 sells for about 86,400 yuan (USD $13,700).

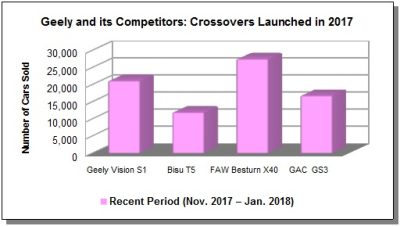

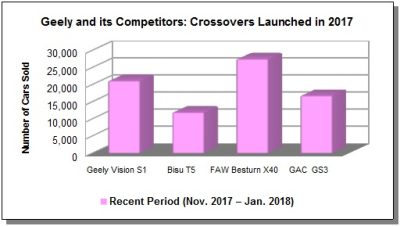

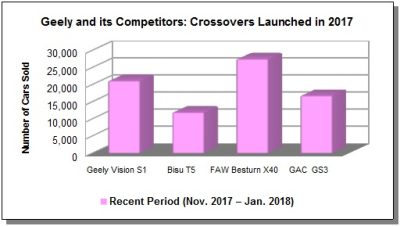

Earlier in 2017, three of Geely’s competitors (Bisu, FAW, and GAC) had already launched their own small crossover hatchbacks; the Bisu T5, the FAW Besturn X40, and the Trumpchi GS3 from GAC. The T5 has an associated selling price of about 81,400 yuan (USD $12,900), the Besturn X40 sells for about 84,300 yuan (USD $13,400), while GAC’s GS3 has a somewhat higher price of 90,000 yuan (USD $14,300).

The graph below compares sales volume for all four models, for the period Nov. 2017 – Jan. 2018. Due to data availability constraints, it was not possible to compare these models over a longer period.

Of the four models considered above, FAW’s Besturn X40 leads the pack in terms of most cars sold. Geely’s Vision S1 had the second highest sales volume, while the GAC GS3 and the Bisu T5 trailed further behind.

Conclusion

In summary, based on both brand rankings and model based comparisons, Geely’s cars are selling well against its competition. This is true for the various categories examined within this article, which included SUVs, Crossovers, Sedans, and small Crossover Hatchbacks. Although Geely’s cars have not always led their competition during the first six months after launch, nevertheless over longer periods (i.e. first twelve months after launch and beyond) Geely has indeed tended to outsell most of its competitors. Geely has also tended to out-compete most of its competitors during the most recent period, which, within the context of this report has been defined as the most recent 3-6 months for which data is available.

Geely’s better designed cars are selling, and there are a number of reasons why we should expect this trend to continue. Geely as a company and as a brand has changed significantly during the last decade. Previously known by many as a company that produced low cost cars with questionable quality, Geely has successfully transformed itself into a company that now produces and sells higher quality and better designed cars, at a competitive price.

Selling more cars, does not by itself, ensure Geely’s corporate success. Numerous other factors related to management, profit margins, earnings, market share, strategic partnerships, etc. are all important with regards to overall success. Nevertheless, at least for the last few years, the reality of “more cars sold” has in fact translated into higher revenues, profits, and earnings for Geely’s shareholders. Readers wishing to learn more about Geely and its competitors from an investment angle, might wish to also read my recently published article on Seeking Alpha.

This is the first contribution on CarSalesBase.com by John McHarris, an Automobile Industry Analyst with an interest in investing. He analyses companies for investment purposes and has recently started to publish some of his analyses. This article is a shortened version of his 40-page report on Geely, edited to better fit with CSB’s audience. Let us know in the comments what you think of his analysis and this article, John would like to contribute more often on our website and would love to get feedback from our readers on how to improve his analysis or make it most enjoyable for our readers.